How to get your tax-refund on your shopping in Nice, Côte d'Azur Airport, South France?

Nice Côte d'Azur Airport

Located in the desirable south of France, Nice Côte d'Azur Airport serves the region of Nice, Monaco and Cannes and is the third busiest airport in France. On average, 13 million passengers pass through its two terminals to benefit from the warmer climate and grandeur of the French Riviera. The region oozes style and sophistication from hosting the famous Cannes film festival, offering stunning views in the beautiful medieval village of Èze and home to a wide variety of boutique and designer shops for your tax-free shopping needs. Why not explore the world-famous Galeries Lafayette in Nice or the small boutiques of the Juan Les Pins area of Antibes. Further down the southern coastline in St Tropez, pick up a pair of handmade Tropezian sandals from world-famous makers Rondini who have been crafting since 1927.

With all that tax-free shopping the region has to offer, let us walk you through how to claim your tax refund on eligible purchases when travelling via Nice airport. If you are travelling via other airports or ferry terminals, be sure to check out our other blogs here for an in-depth walk-through. You can also check out our other guides which offer VAT refund hints and tips when shopping in France.

What you need to know about tax refunds?

Non-EU residents can enjoy VAT refunds on their tax-free shopping such as technology, clothing, wine and cosmetics. As a result of Brexit, Brits can now enjoy these savings and receive VAT refunds on eligible purchases in France. Check out our other guides and blogs on the do’s and don’ts for more help.

Nice Côte d'Azur Airport

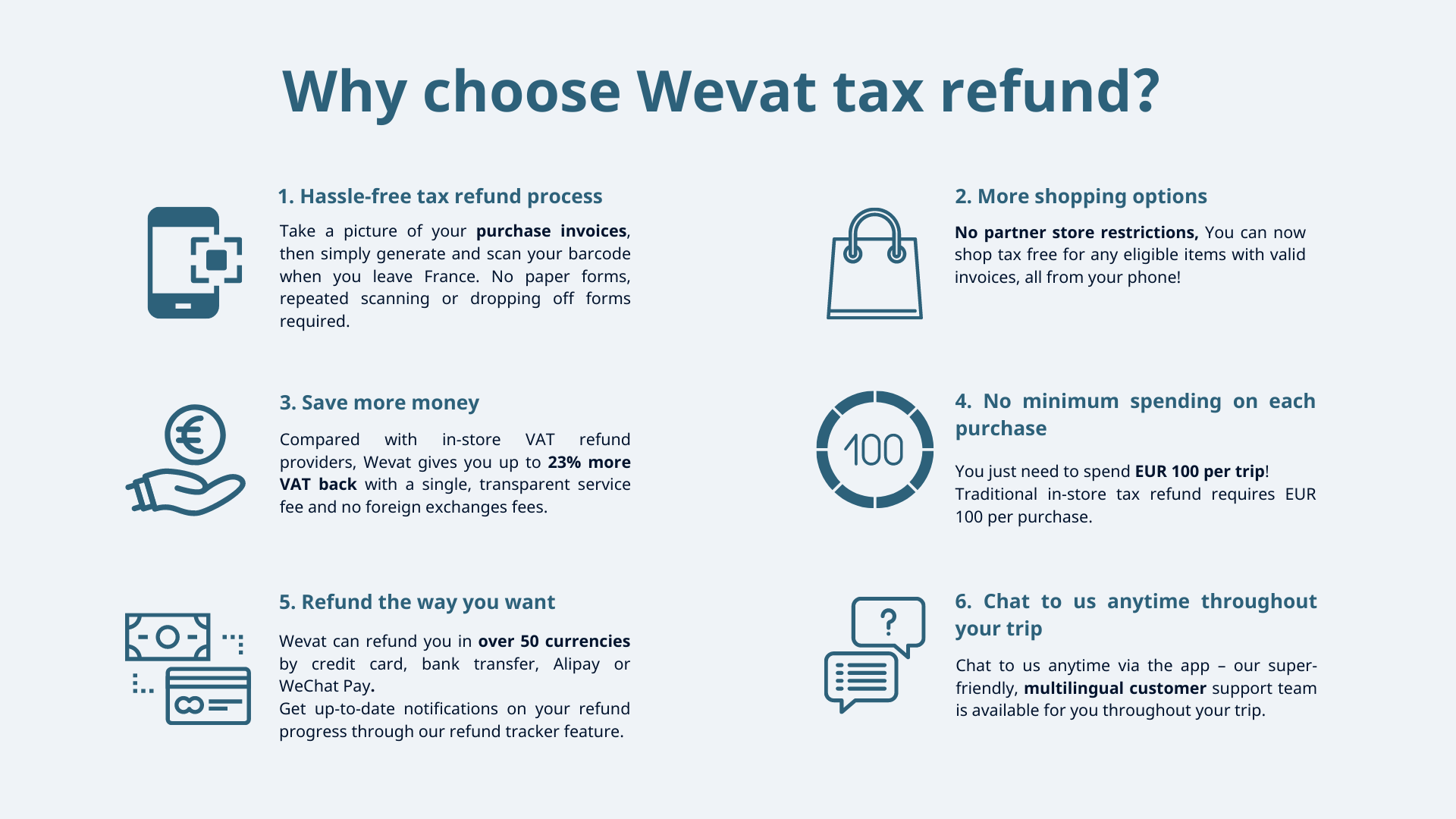

There are two main ways you can get a tax refund - using a traditional in-store paper method, or a digital app like Wevat. With Wevat you receive more of your money back compared with the in-store method. You can also leave your passport safely locked at your hotel rather than drag it around to every shop – eliminating the risk of it being lost or stolen. If spending money is limited, you can also benefit from a lower minimum spend of €100 across all your purchases rather than €100 per store. You’ll also find that many boutiques and small shops are not partnered with big VAT refund companies which is where Wevat comes in handy for those small purchases. Other benefits of using Wevat include the ability to keep updated on your refunds within the app and that Wevat provides spot rate on refunds. Currency rates from exchange counters at the airport are often much lower than those set online meaning a lower than expected tax refund offered when using traditional methods.

You may end up with a combination of paper and digital invoices depending on the stores you use, and this is totally fine. Where possible, using the Wevat app to process your ‘factures’ or invoices into (e)refund forms will save you time and money overall – our other guides explain in more detail how.

Whichever method you choose, you will need to go to your departure station/ ferry/ airport to get your (e)refund form validated at customs before you leave the EU. Most locations such as Nice airport benefit from electronic self-service VAT refund terminals (PABLO) to streamline the whole VAT refund process. In fact, by using the Wevat app and PABLO terminals, the refund process could not be simpler!

Before travelling to the airport for your departure flight:

There are a few steps you need to take before your departure flight to avoid claim rejections.

Sign up to the Wevat app before you shop

Ask for an invoice when you shop and upload your invoices (known as ‘facture’) in-app as soon as you shop

Generate your (e)refund form in-app

Have your invoices and shopping together as French Customs may ask to see these at the airport, so make sure they're packed somewhere accessible like your hand luggage for now.

Should you encounter any problems uploading your invoices or ‘facture’ to the Wevat app, contact our customer support via the in-app chat who will gladly help you.

Get VAT refund with Wevat at Galeries Lafayette in Nice

Step by step process on your departure from Nice airport

Before passing through the security checkpoints and entering the departure lounge, make sure you follow these steps to claim your tax refund;

Step 1 - Find the PABLO détaxe Tax refund self-service kiosks located in your terminal:

PABLO self-service terminals are located near the arrivals area of each terminal in Nice airport. There are two terminals at the airport so make sure you check in advance which one your flight departs from. If you have passed through security and are at the departure gate, you have missed Customs!

Terminal 1 PABLO détaxe Tax refund self-service kiosks

Terminal 2 PABLO détaxe Tax refund self-service kiosks

Step 2 - Follow the PABLO on-screen instructions to get your tax refund approved:

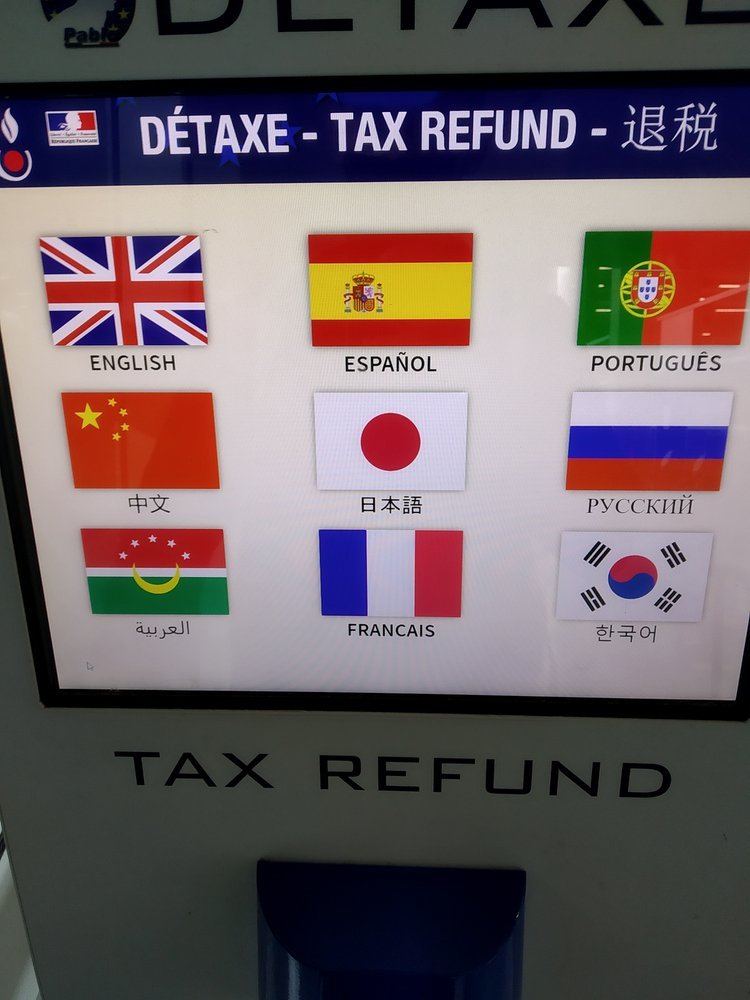

Select your language

Scan the barcode on your digital form in the Wevat app

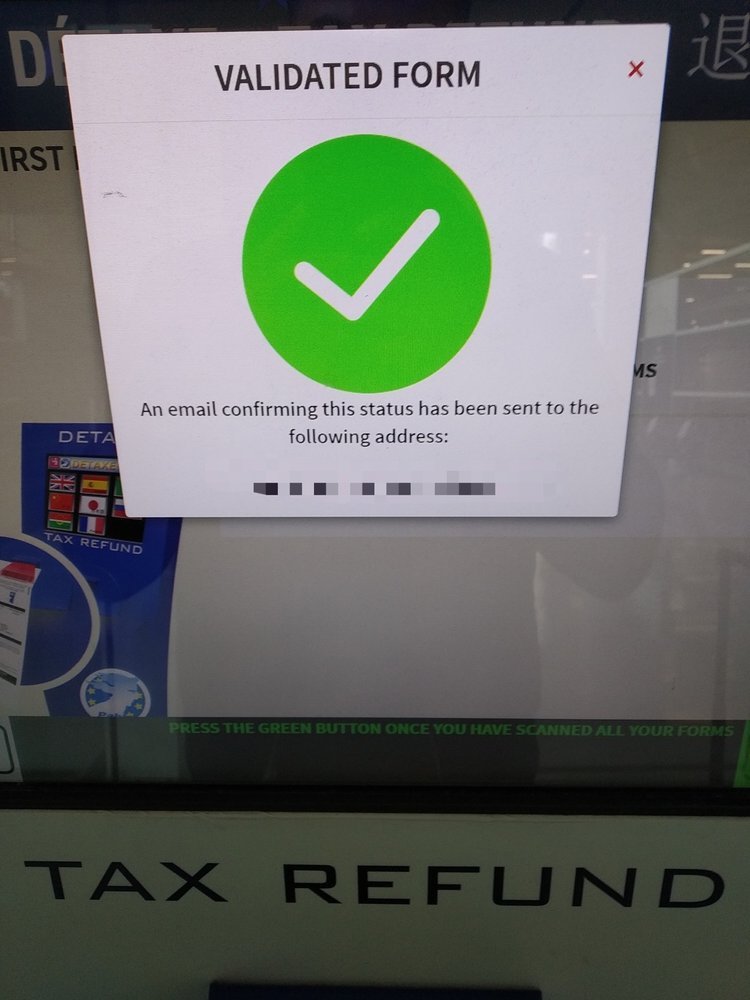

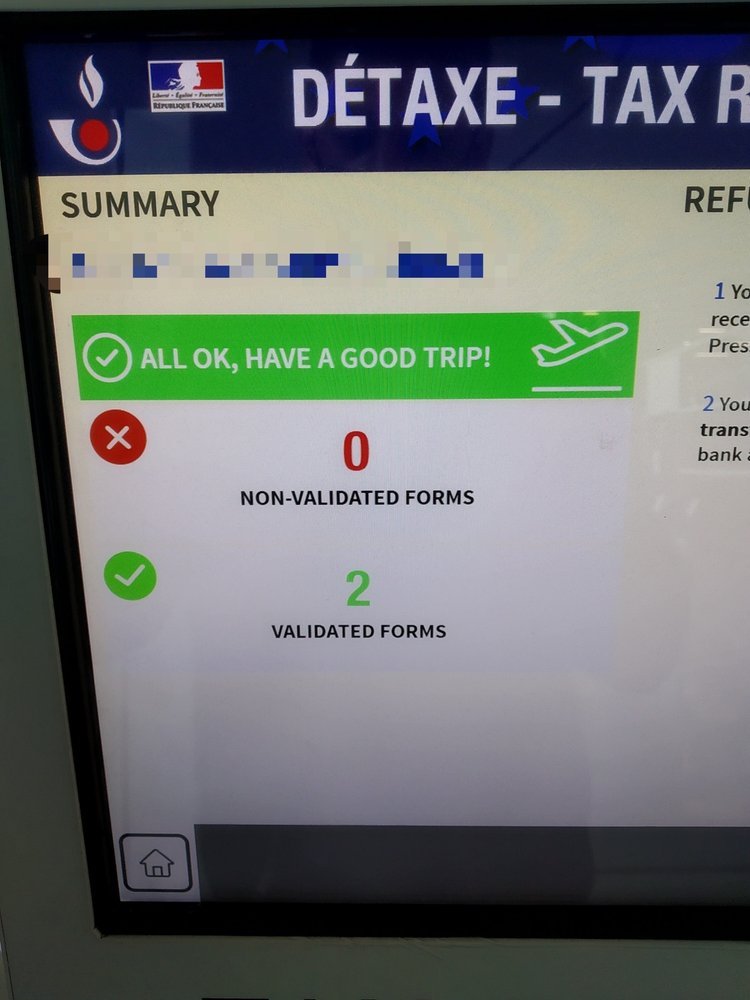

Wait for the customs approval (a green screen will appear with the message "Form valid"). We also recommend that you take a picture of the screen for your records.

If you have any traditional paper tax refund forms, scan the barcodes one by one as above. These validated paper forms will then need to be mailed into the designated refund mail box with the original receipts (most often located on the customs desk near the PABLO machine).

If you encounter any issues with the self-service machines (i.e. barcode not scanning, or an error screen), seek assistance at a manned customs desk nearby.

Please note: You may be asked to show your shopping, invoices and receipts to the French Customs agents, so make sure they are easily accessible. This is why we recommend doing your tax refund before checking in your baggage (in case the Customs officer needs to see the items you have purchased). Once you have completed the tax refund you can pack your items away in your checked luggage if necessary.

Tax refund kiosk

Select language-tax refund kiosk

Form validated-tax refund kiosk

Validated form number-tax refund kiosk

Step 3 – Head off to your check-in desk to continue your journey back to the UK!

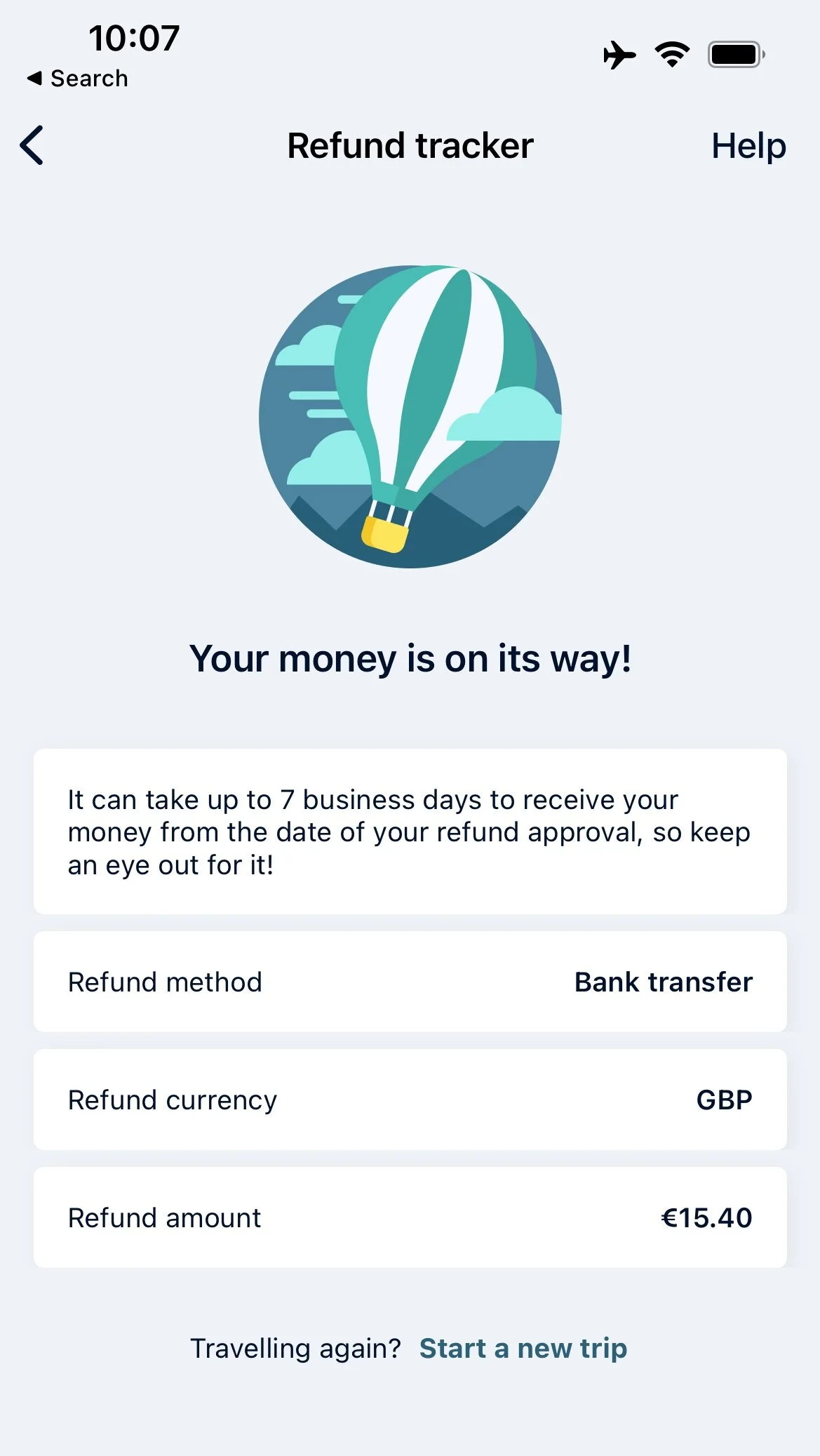

Once you have completed the tax refund process, you can head off to your airline check in desk, continue onto security and finally relax at your boarding gate before your flight home. Your refund will be confirmed within 2 days from Wevat, then we will proceed with your refund.

Bon Voyage!

It’s as simple as that! We promise that after you have followed this process once, you will find it much easier and quicker to do in the future. If at any point you get stuck, just contact a customs official at the airport. We are also available to guide you should you need any further assistance - we are happy to help! Don’t forget to share your experiences with friends and family so that others can discover the joys of VAT-free shopping.

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.