How to benefit from tax free shopping on your online shopping in France?

Online shoppers rejoice...tax free shopping has just got a little bit easier with Wevat (hooray!). You can now obtain a VAT refund on eligible online purchases with French registered retailers. No need to miss out on those online bargains anymore!

Travellers can now benefit from ordering their tax-free purchases in advance for collection with eligible retailers when out in France. There is also the option to have your order delivered to one of the many pickup points/lockers in France which are partnered with more than 6500 websites! These pickup lockers can be found in most railways, post offices, large retailers and in public areas across France so you’re bound to find one close to your location using their online map. Plus, if you have friends and family who live in France, you can get deliveries sent to them as well.

There are many benefits to online shopping such as the increase in retailers and collections you can choose from, the ability to compare prices across different websites plus making use of any discount codes and cashback sites (with certain retailers). When you combine those extra savings with tax-free shopping, the whole experience becomes so much more affordable, time-saving and enjoyable. No need to walk for miles visiting multiple stores for those elusive bargains…your feet will certainly thank you!

Tax-free online shopping is also an ideal solution for those who may feel anxious trying to obtain an invoice (known as a ‘facture’) with a French-speaking salesperson. When combined with using a pickup locker (most available 24/7), you won't need to worry about speaking bad French to sales staff when collecting your order!

Some French websites to consider for those VAT savings are Amazon France, Galeries Lafayette, 24s and quite a few boutique French brands such as Polene, Ami Paris and Tammy & Benjamin. Just be sure to visit the French site of global websites (see below for more guidance on this).

So, how does it work, and how does it differ from the usual instore method when obtaining an invoice or ‘facture’ for eligible purchases? Let's walk you through with these easy steps.

Before shopping online, you need to ensure:

You are shopping at a French-registered retailer. The retailer must be VAT registered and based in France - look for a “VAT” or “TVA” number starting with “FR” - We suggest you check with the retailer before you shop. You can do this by looking at the T&Cs on their website to check it is incorporated in France.

It must be delivered to an address in France. You can choose to Click and collect at a shop in France or make use of a Pickup point/locker as mentioned above.

You are eligible to use Wevat and shop goods that are eligible for a tax refund. Check out our FAQ page to learn more.

How to get a tax refund for online shopping?

Step 1: Sign up to Wevat and check your eligibility

Step 2: Shop online and obtain an invoice addressed to Wevat by entering the following details under the billing address section:

Company name / First and last name: Vatcat France

Address: 41 Cours de la Liberté, 69003 Lyon

When you process your online order, in the payments section you can usually add the above address in the “company” part. If that option is not available, you can insert “Vatcat” as a first name and “France” as a last name or you can ask their customer support team to issue one for you.

IMPORTANT- Please make sure you have entered our address as the billing address and not use the delivery address, as the retailer may end up delivering your items to our office.)

⚠️ If you select Click & Collect, some shops such as luxury boutiques may not have a billing address section or enterprise name when customers order online. In such cases, please ensure that you enter your name in the 'First name' field and 'Vatcat France' in the 'Last name' field.

Step 3: Choose your delivery address - whether that is from the store with click and collect or by using an address in France such as the Pickup lockers.

Step 4: Once you have received or collected your goods, please forward your invoice to e-invoices@wevat.com and insert the email address linked to your Wevat account in the subject line.

Hermes e-invoice

Step 5: Scan your in-app barcode at your departure point airport, Eurostar or ferry terminal. Make sure to have your unused online and offline goods ready for inspection at customs at departure.

Step 6: Receive your refund – this will be confirmed within two days after your departure and paid within three months.

We hope you enjoy this latest benefit to your shopping experience and discover many more French retailers. With the joys of purchasing goods online from across France, you can now benefit from a wider range of retailers...not just those in the area you are visiting. Just make sure you have room in your suitcase for all those extra purchases that were made possible thanks to Wevat.

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

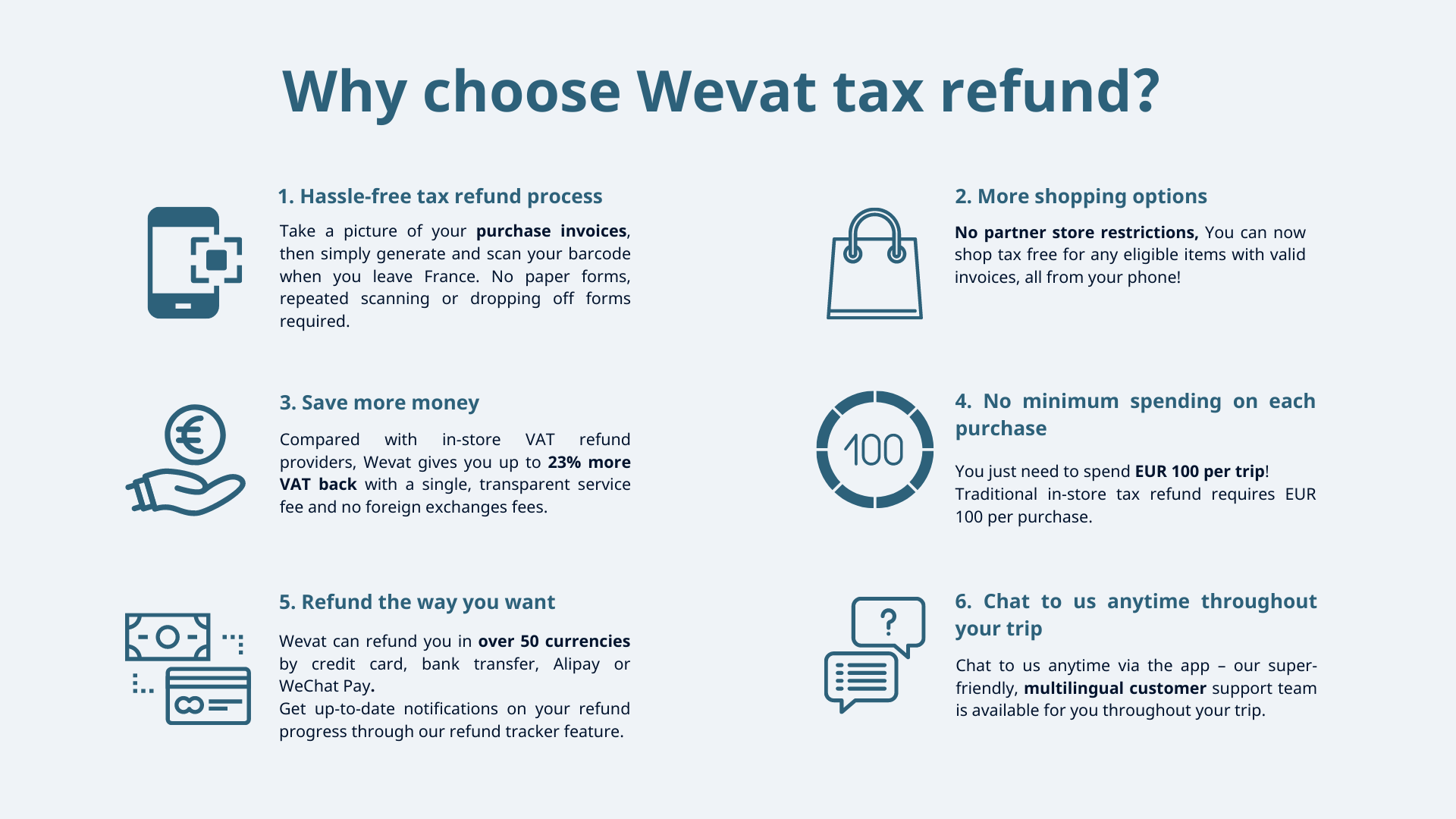

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.