Can I get VAT back at any shop when travelling to France as a tourist?

The simple answer is almost..but It depends on what you purchase and where you shop in France.

To make your tax refund experience more smooth during your trip in France, we are writing this article so you can easily know where to shop and how to shop during your trip.

Galeries Lafayette Haussmann

First, ensure the items you purchase are eligible for tax-free shopping in France.

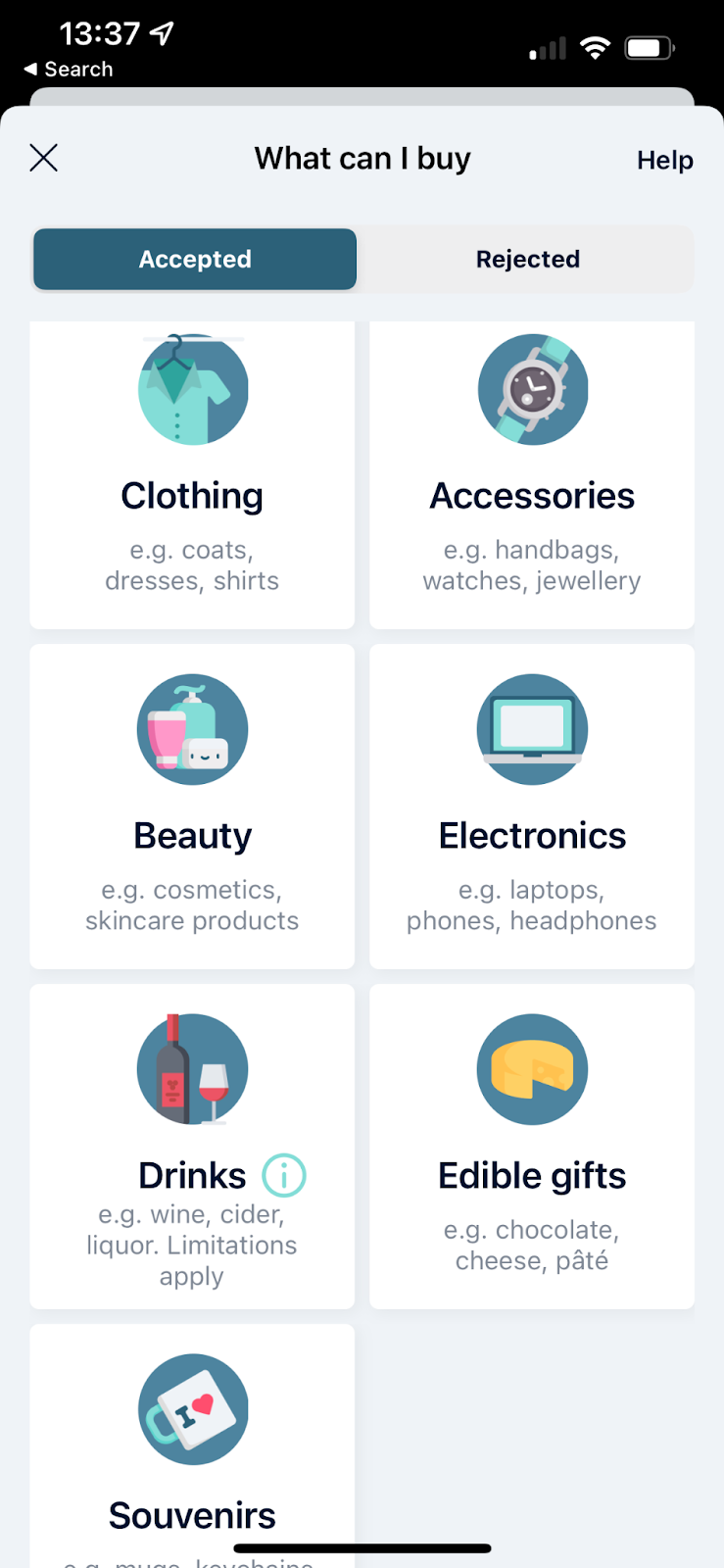

As a tourist, VAT can be claimed back on most items purchased in France as long as they are for personal use and taken when you leave. Items include clothing, accessories, jewellery, technology, and cosmetics. Check out our previous article What items can travellers claim VAT refund on in France for more details on which items you cannot claim VAT and how to avoid claim rejection at customs. Or you can just simply tap the section ”What can I buy” in the Wevat app to easily check eligible goods. The general rule is you can claim VAT for items you will not use on your trip – things like museum tickets or food eaten on your trip are therefore excluded.

Secondly, it depends on which tax refund method you chose and there are pros and cons for both:

1. Traditional in-store tax refund with manual filling and paper refund forms

2. Digitised tax refund app Wevat - with everything in one app

1. Traditional in-store tax refund with manual filling and paper refund forms

If you go down the traditional in-store tax refund method, you can only get a tax refund with traditional tax refund providers (like Global blue, Planet) that the retailer is partnered with. If they are partnered with one of these companies, you can normally find a tax refund sticker in the shop. Retailers that are only popular with locals or that aren’t aimed at tourists specifically are unlikely to offer traditional paper-based tax refunds.

Pros: Since the traditional tax refund providers are partnered with the retailers, the staff will understand how to issue a paper refund form.

Cons: As a business-to-business model (B2B) where the retailer works in partnership with the traditional tax player, these shops will take a cut from your refund. This means the refund you take home would be less than if you used a digital refund app like Wevat, which has a business-to-consumer (B2C) model.

2. Digitalised tax refund app Wevat

In comparison, a digitised tax refund app, like Wevat, is based on a B2C model and deals directly with the customer. When purchasing your goods, you’ll need to obtain a valid purchase invoice (or “facture” in French) and make sure it is addressed to Wevat. Instructions on how to do this can all be found in the app. You can get a tax refund from any eligible purchase with a valid invoice. This means you don’t have to restrict yourself to shopping only at the retailers that have partnered with a tax-reclaim company.

Take a shot of the invoice with the in-app camera, then upload with a single tap. Wevat will generate a digital refund form with all of the purchase information, then simply scan the barcode in the app at the airport or station.

Pros: You get more of the refund because the retailer doesn’t take a cut. No more paper forms to carry around each time you shop, or potentially lose! You can also track your refund in the app and talk with in-app customer support chat very easily. It’s also worth remembering that traditional in-store tax refunds require a minimum spend of €100 per purchase or shop, whereas with Wevat the €100 minimum purchase is per trip.

Take home refund: Wevat 13% vs Traditional tax refund 8%-12%

Cons: As mentioned, Wevat adopts a B2C tax refund model so some of the shop staff might not be familiar with this new tax refund method. They might also be keener for you to use the traditional tax refund so they can still get the cut from your refund. Based on Wevat’s users’ feedback, there are a couple of shops that might be hard for you to get an invoice (for example, Louis Vuitton).

The good news is the majority of the shops can issue an invoice easily. Stores also have a legal obligation to issue invoices upon request. You do not have to provide any justification when you request an invoice as supported by a statement on the French authority's official website which you can find here.

We would suggest checking with the store staff before shopping. If they can issue an invoice addressed to Wevat, go ahead with the Wevat app for higher refunds and more convenience. Alternatively, you can still use the traditional method offered by retailers for a tax-refund, (i.e. a paper form.)

Ok – so how does it work with Wevat app?

You can find an example of what a valid facture looks like here on our help centre. This shows the detail which is required to ensure your invoice is not rejected by our app. Remember – to ensure your tax refund is processed, the invoice must be addressed to Wevat and not yourself!

Step 1 - Make sure you have downloaded the Wevap app and completed the sign up before making purchases. You’ll also want to ensure you are eligible to claim VAT refunds and that you’re departing from a Wevat supported exit point, which can be found here.

Step 2 - The fun part...go shopping! When paying for goods, ask for a facture (invoice in French) or just show the 'request invoice screen' on the app to the salesperson to request an invoice that is addressed to Wevat. This screen shows all the information you need for an invoice including Wevat’s company name and address etc.

Double check your invoice contains the right details that match the screen. If you have any questions about your invoice, please contact our customer service team using the in-app chat.

Step 3 - Upload the invoice – it's that simple! This will be checked and verified by our team usually in a few hours. It’s best to upload as you shop to avoid delays.

Step 4 – Do a victory dance or shop some more (we promise we won’t judge!). Leave some time to verify your identity, and generate your e-refund form in the app if you’ve finished all shopping. Just remember to keep hold of your invoices, receipts and any other paper tax refund forms when you come to validate your e-refund form at customs before you leave France in case customs do a random check.

Step 5 – Bring your goods to a Wevat supported departure point, which are listed here. Scan the refund barcode at a PABLO kiosk before leaving France. You’ll then receive your refund soon in your selected currency and refund method.

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

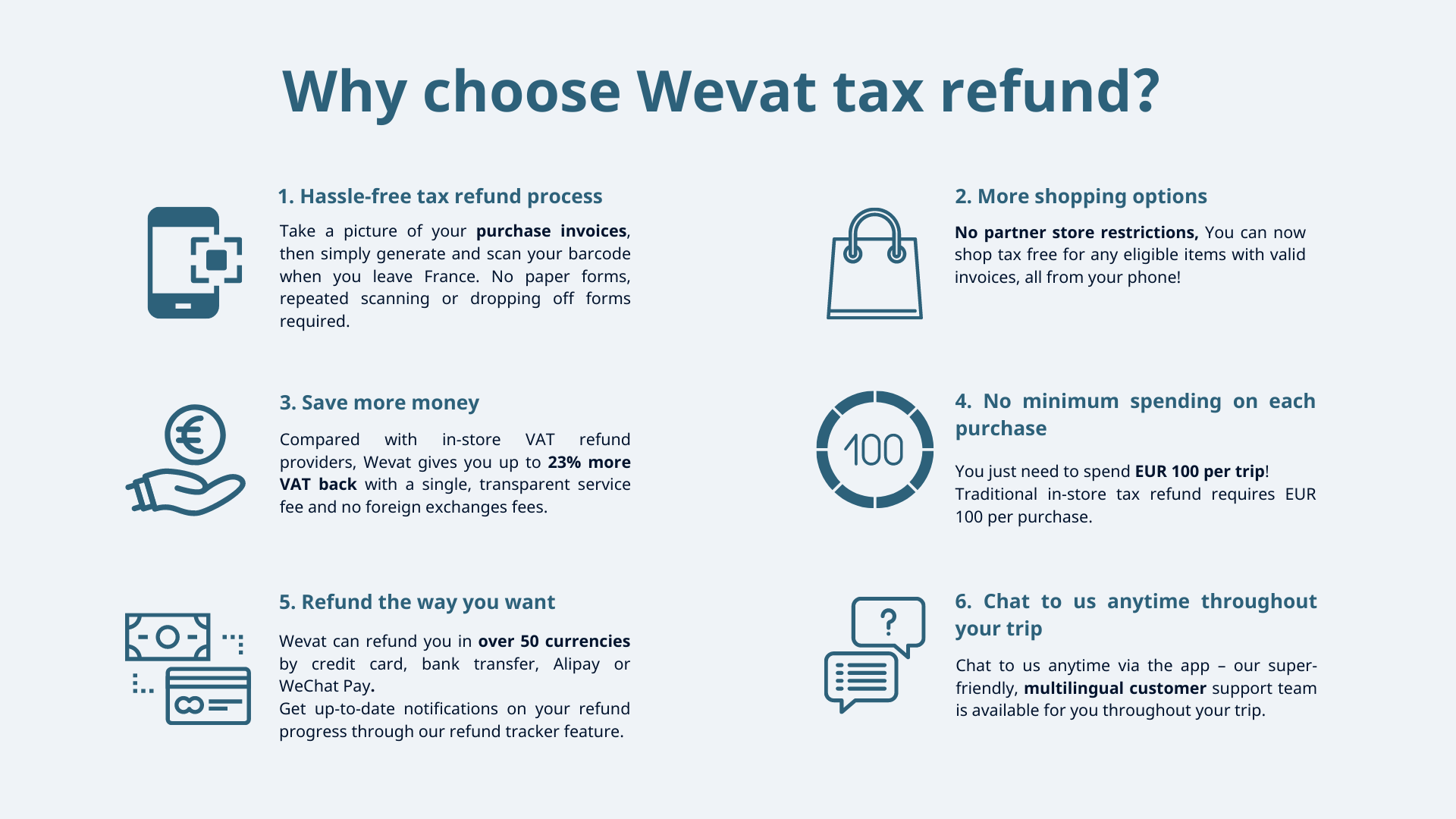

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.