How to get tax-refund in Gare du Nord in Paris, France Eurostar station?

Did you know that British travellers are missing out on reclaiming hundreds of pounds worth of refund when shopping in the EU? Well, if you're reading this article then you're probably aware of VAT-refunds and you want to know how to claim your tax refund when returning from France through Gare du Nord station. Continue reading to find out more about tax-free shopping and how it can save you loads of money and how to claim your refund at Gare du Nord station!

What you need to know before heading to Gare du Nord station?

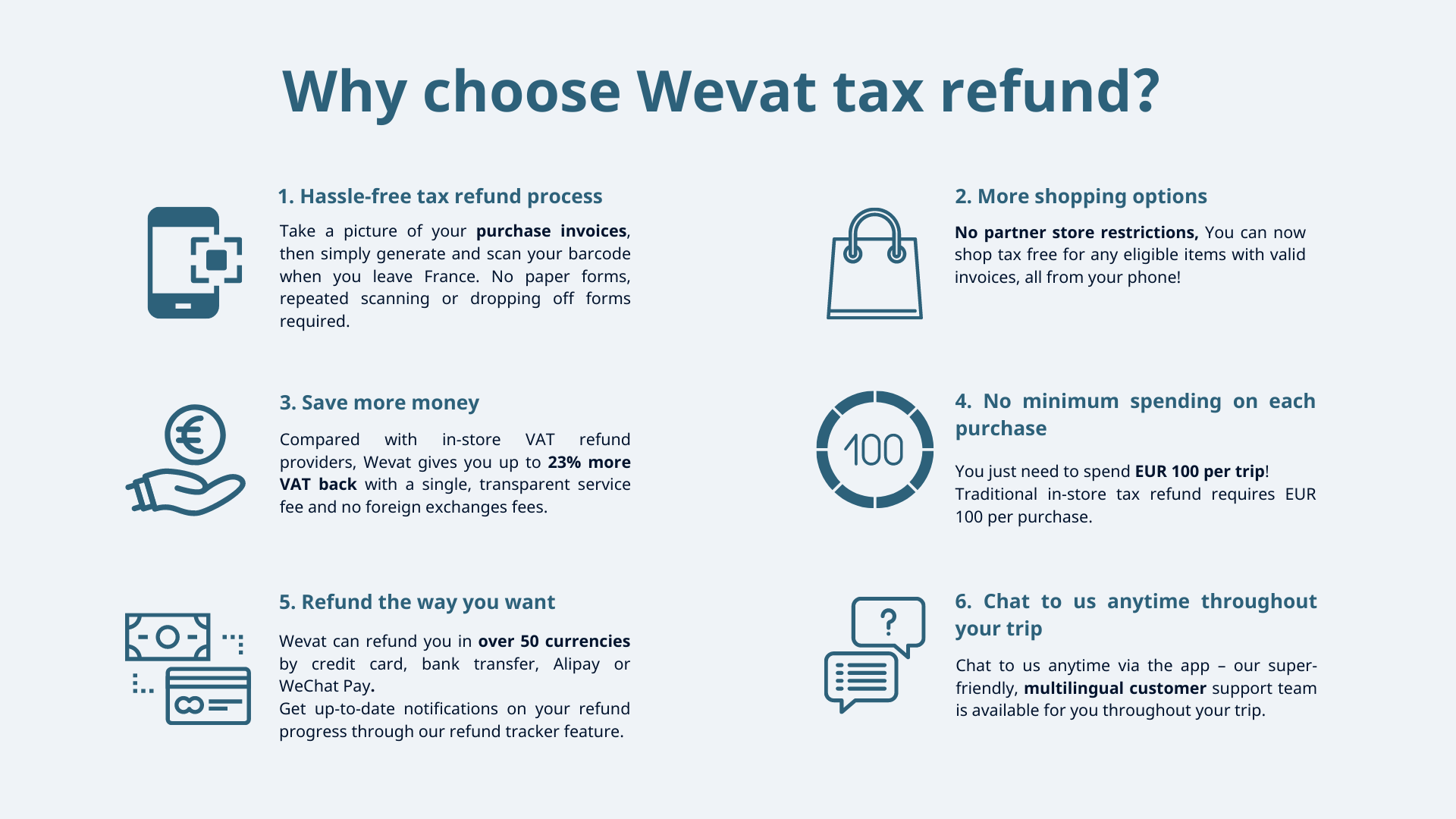

There are two main ways you can get tax-refund - using a traditional in-store paper method or a digitalised app version that lets you do it all from the ease of your phone. There are a few differences when it comes to each method: Traditional in-store one has more support from shop staff, however digital tax refund app like Wevat is more caring for the tourists. The main perk of using a digitalised method with Wevat is you get more money back compared with in-store method, besides you only have to spend a total of €100 across all your purchases rather than €100 per store.

Please notice no matter which method you chose, you all need to go to the station/airport to get your (e)refund form validated at the customs before you leave the EU.

Once you arrive at the Gare du Nord station station:

Please ensure you bring all the paper tax refund forms issued from shop or generate a barcode(which is digital e-refund form) from Wevat app. Please keep all your invoice, receipts and make sure your items are unopened and ready for inspection.

Here's a walk through what you need to do once you have arrived at the station.

Step 1: Enter ticket gates

Have your tickets ready and go through the gates - pretty straight forward! During peak times there may be a longer queue so make sure you arrive with lots of time so you can go through your tax-refund process when you get to customs.

Step 2: Go through customs

You will first go through French customs and then the UK customs where - don't worry the custom desks and tax-refund kiosks are yet to come.

Step 3: Go through security checks

All the usual stuff with security and bag checks!

Step 4: Using Wevat - follow détaxe signs (tax refund) to arrive at the kiosks!

Once you go through security, you should see signs (Détaxe) leading to a self-service kiosks - this is where you will process your refund! If you can't find the kiosks, just ask staff to direct you to the tax-refund kiosks.

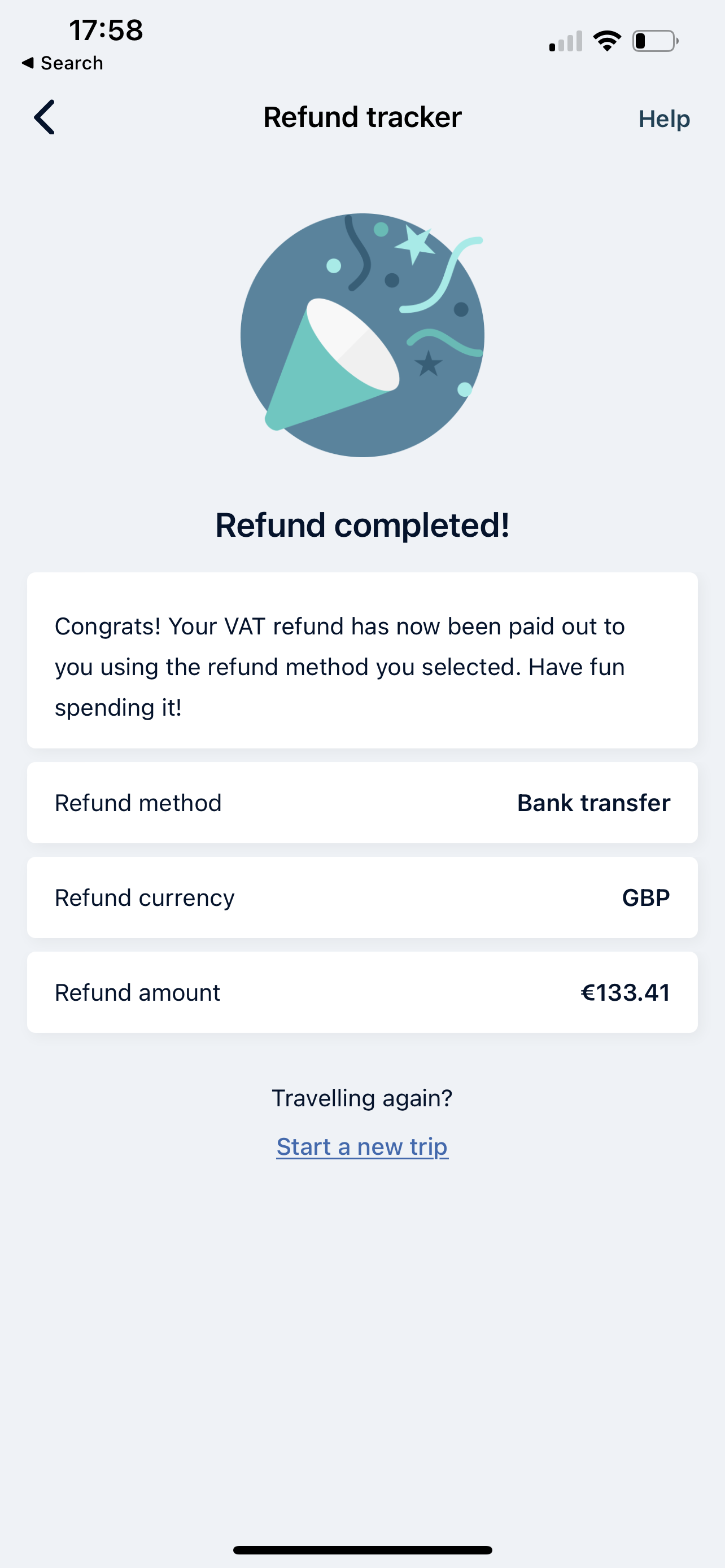

Here you will follow the straightforward on screen instructions, with multiple language choices for you to choose from, where you will be prompted to scan the barcode you've generated on the Wevat app. This screen below which reads 'validated form' is what you should see after scanning the barcode meaning that it has been successful! Once you have it's been approved, you will see the screen on your refund tracker section showing your money is on its way the day after your departure. All that's left to do is wait to receive your refund via your preferred refund method.

Step 4: Traditional refund - follow détaxe signs (tax refund) to arrive at the refund desk

If you have got traditional paper tax refund forms, please get your forms ready to scan the barcode on the forms at tax refund kiosk one by one.

You can then mail your validated refund form and all original receipts into the mail box at the station. It is not easy to find the mail box so please ask the staff for help if you need to. Then you will receive your refund back the method you chose on when you issue the tax refund forms in the shop. You can email traditional tax refund company if you want to check if its status.

Please notice:

Occasionally, the customs will manually check your purchase, invoice and receipts. They are sitting right next to the self-service kiosks. Here you will get your forms and goods checked.

Success!

You should receive your refund shortly - it's as simple as that! Meanwhile you can take your goods home to enjoy and use and wait for some money to get transferred back into your account. Minimal hassle, lots of new stuff for you to enjoy and saving money too, it's a win win situation all round!

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

If you have any more queries or question regarding tax-free shopping in France or about our app then please contact us via our app or our or social media @wevatapp!

Please download before purchase to validate shopping.