What items can UK travellers claim VAT-refunds on in France?

Travelling to France could be a possibility very soon with the hopes of travel restrictions easing and international travel seeming more likely. This time round Brits get to enjoy a new perk of travelling that Brexit has allowed that is tax-free shopping in the EU! Wevat will provide UK travellers with an easy and simple service that allows you to do VAT-free shopping in France which will save you time and money.

Since we all love finding deals and discounts on our shopping sprees so what better way to guarantee saving money than to try out tax-free shopping on your next trip to France? Luckily, most items will be valid and eligible for a VAT-refund as long as you purchase the items under the eligibility conditions you can find here. This little guide will fully prepare you with the knowledge on what items you can or cannot get a VAT-refund on.

A key thing to note is to get your purchase invoices (known as a ‘facture’ in French) addressed to Wevat - just ask your assistant for a ‘facture’ addressed to Wevat at the end of your transaction! So what transactions can be enjoyed tax free?

Sephora store on the avenue des Champs-Elysées, Paris, France

If you’re a fashion and beauty enthusiast then you won’t be disappointed! Products that fall under this category are completely eligible for a VAT-refund (as long as the retailer provides an invoice addressed to Wevat). France is famous for its luxury fashion houses and chic boutiques so shopping choices will be endless! For items such as clothes, bags, shoes, jewelry & accessories etc you can visit a range of stores like Sandro, Maje, Etam, Hermes etc who will provide you with facture addressed to Wevat. Think of all the popular shopping districts and department stores in France such Avenue des Champs-Elysees, Galeries Lafayette and Le Marais where you can shop till you drop and save lots of money on your purchases!

Those who prefer beauty cosmetics such as makeup, skincare, hair-care etc can also enjoy tax-free shopping - think places such as Sephora and Marionnaud where you can purchase anything and everything beauty-related from luxury skincare to makeup. Skincare products have been all the hype recently and we know that high street stores such as Boots are often out of stock for the most popular brands, which mostly happen to be French brands. So you can stock up on your favourite skincare all whilst saving money! We're talking about the most raved skincare brands such as La Roche Posay, Avène, Eucerin, Bioderma and many more that you can shop for tax-free.

It's also a great opportunity to get your hands on makeup brands that you can't easily get in the UK such as the Sephora collection, rare beauty, milk makeup or many other popular brands such as Chanel or Dior that you may just want to save money on! To avoid any disappointment, it would be useful before you purchase any items to ask the store if they will provide an invoice addressed to Wevat.

If fashion & beauty is not your thing, there are plenty more goods you claim VAT-refunds on - maybe electronics/gadgets are more your style such as smartwatches, cameras, phones etc. You will find plenty of department stores throughout France where you can purchase a huge range of products you could be looking for. Perhaps you want to take back a little memento from your trip to France or a little souvenir from a museum you visited; all these will be eligible for a VAT-refund!

Champs-Elysées, Paris, France

Lastly, everyone knows Brits are famous for our ability to drink the night away and luckily France is full of exquisite wines and alcohols that will perfectly fit our taste! You can purchase these beverages tax-free to bring back to the UK and enjoy them in the future - ensured you don't drink them before you claim the VAT refund at customs!

Now for the things you cannot claim a VAT-refund on which will be just as important for you to remember!

Any purchase of services such as (but not limited to): museum tickets, concert tickets, hotels, car rental, fuel, restaurant bills

Tobacco - any kind

Pharmaceuticals

Foods you consumed in France

Car/car parts

Items with no VAT included

Invoices that show exchange or returned items - instead return and repurchase for a completely new 'facture' of the item to be eligible!

Before you leave customs in France you need to make sure you keep your shopping in its original packaging and unused as well as keeping all your receipts ready for inspection. After this, you’re all set to claim your VAT-refund and enjoy all these goods back home in the UK!

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

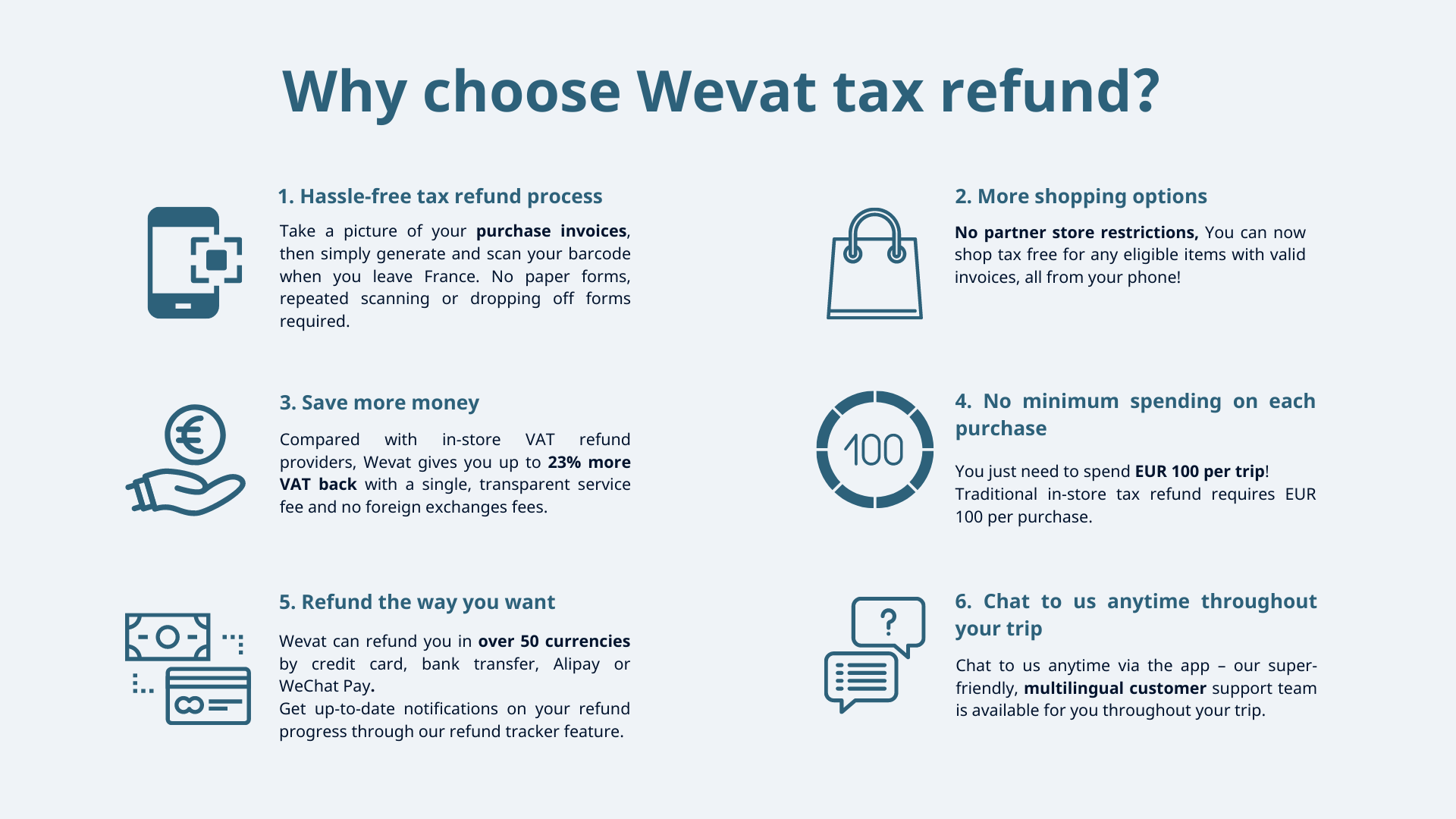

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download Wevat now and start save money on your shopping!

Please download before purchase to validate shopping.