How can British tourist claim tax-refunds on shopping in France?

You may not be aware that tax-free shopping is now available to British tourists who shop abroad in the EU! Due to Brexit, we are no longer part of the EU therefore we do not have to pay any VAT on items we buy to bring back to the UK. If you are planning to travel to France soon, then you should be aware that you can claim tax-refund through two different methods - the traditional in-store manual VAT refund way or using a digitised app version such as Wevat.

If you're new to tax-refund/tax-free shopping then it can get a little tricky to understand all the rules and regulations but we’re here to make this information and process easy to understand. Here's one of our articles that explains more on ‘how to get tax-free shopping’ if you want to claim any tax-refund in the future.

We want to make sure your departure back to the UK is as smooth as possible when claiming your refunds so read on to learn everything about preparing for your departure from France. So, whilst this isn't the most exciting part about any trip, knowing that you'll be getting some money back through VAT-refunds gives you something to be excited about!

Purchase time:

Since you do not want to miss out on tax-free shopping, it’s crucial that you are aware of the time requirements on when your purchases will be eligible for a refund. Make sure you take note of these three important criterias for the purchase time of your goods.

Firstly, your trip to France must not be over 6 months or the items you’ve purchased will not be eligible.

Secondly, the date of your purchase must be on or after the date of your arrival in France and of course, after you download & sign in Wevat app as well.

Last but most importantly, you must leave France and the EU with your purchase within 3 months following the month in which you bought your item.

For example, if you are leaving in June (1st-30th), the earliest date you can make an eligible purchase is 1st March. See the guide below for a full breakdown:

During Shopping:

Whilst you're shopping it's important that you know what you purchase is eligible for a refund and you get the right type of documents. Some things unfortunately aren't eligible for a refund including purchases of any service although most things that are of a retail or tourist nature should be eligible. Here's a more comprehensive guide on everything that is and isn't eligible for a tax refund.

Also, whilst you're shopping, make sure you do these things below to ensure your items can be approved at customs:

If you go for traditional tax-refund method, you need to make sure the store offer tax-refund service. You need to ask for a tax-refund form from the stores and might need to fill in your personal info. every time you purchase the goods (you’ll need to spend a minimum of €100 per store).

If you are using a Wevat for VAT refund, all you need to do is to ask for a 'facture' (invoice) for all the items you've bought addressed to Wevat. (Please do not issue a tax-refund form in store if you use Wevat for claiming VAT refund and ensure you spend €100 per trip)

Before departure:

When the day comes where it’s time to leave France, it won't be all sad news as this is where you’ll get to process all your invoices/receipts and paperwork to claim your tax-refunds. But before you arrive at the departure point, make sure you have everything in check so that your refund process can go smoothly as possible. Here's everything you need to know to make this possible:

Allow for plenty of extra time at the airport to get your forms validated at the PABLO détaxe kiosk or at Customs

Have your passport on hand

Ready all the original invoices/receipts of the goods you purchased with the paper tax-refund forms from the stores or generating a barcode containing electric tax refund form in the Wevat app

Keep your goods unused, in original packaging and make sure they're not in checked-in luggage as they should be kept available for inspection

Paris Charles de Gaulle Airport

After you've prepared with the steps above, you're all set to get your refund processed. As mentioned, you can either scan your barcode at PABLO détaxe kiosk at your departure point or if some departure points do not have a kiosks you can go to Customs. At Customs, you will need to show all the relevant forms and receipts where it will be approved and stamped. You will need to find the post box at airports/train station and pack all the receipts in an envelope and throw in it if you have traditional in-store tax refund form.

Currently, Wevat supports these main departure points from France where your form can be validated at the PABLO détaxe kiosk. At each departure point there will be a PABLO tax refund self-service détaxe kiosk where you will need to follow the on-screen instructions. It may sound complicated but the instructions are easy to follow and you'll get your form validated in no time by just scanning the barcode in Wevat App! We advise you to take a picture of your validated or stamped forms as evidence just in case anything were to happen!

Make sure you exit into a non-EU country:

One last thing to note, on your departure you must exit into a non-EU country to get your VAT-refund. So if you are travelling around the EU and shop in multiple different countries, you will have to show all the necessary documents at the Customs office of the last EU country you're in before your departure. You can travel into France or the EU from any country as long as you're going to be returning to the UK as a resident in order to claim tax-refund.

Now that double-vaccinated adults can travel into France without having to quarantine upon their return to the UK, we hope that UK citizens will enjoy travels to France and take as much advantage of this new tax-free shopping perk!

If you have any further questions on tax-free shopping, please get in touch with us!

Bon Vovage!

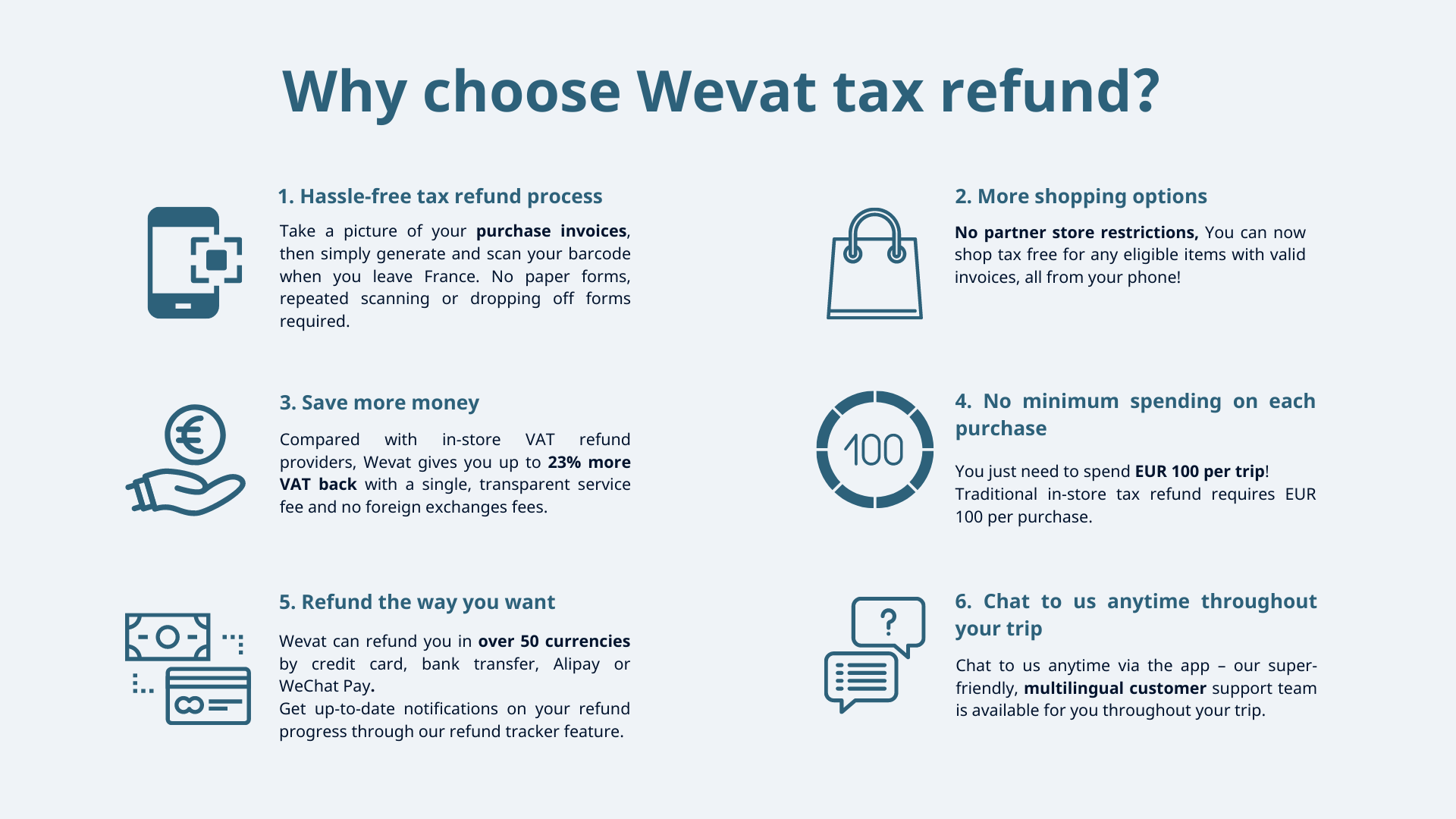

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.