How to get tax-free shopping in France for British travellers - what you need to know!

Holidays and travelling abroad are looking more promising as Brits who have been double vaccinated could soon be allowed to travel without having to isolate. So if you are preparing yourself for your next trip abroad, then as a UK citizen you should know that you’ll be able to save some money whilst travelling to France or EU countries by getting VAT refunds on your shopping!

Photo by Silvia Trigo from Pexels

What is a VAT refund?

A VAT-refund is simply claiming back the ‘tax’ that is usually added on to goods in most countries, including France. If you live in the UK and make purchases whilst travelling to France take back to the UK, you do not have to pay the VAT on these items. This new perk is one of the benefits that Brexit has given to British travellers - since the UK is no longer part of the EU, we do not have to pay any VAT on goods we purchase in EU countries. So next time you travel to an EU country, you can save up to 20% (fees may apply) of the price on goods you purchase!

How can you enjoy tax-free shopping?

We want you to save as much money as possible whilst travelling in France so here are some important things to note in order to be eligible for a VAT refund:

1. Non-EU resident requirement

To get a VAT refund in France, you need to have a permanent address outside of France and the EU so if you’re visiting from the UK, you’re good to go! Just make sure your stay in France is less than 6 months and depart back into another non-EU country.

2. Minimum purchases

The total value of your shopping, across all of your different purchases, must be worth a minimum of €100 (including VAT) if you use Wevat whereas if you chose to get VAT refund in-store through the traditional process then each single purchase transaction must be minimum €100 (including VAT). Whether you’re spending that on clothes, makeup/beauty products, bags, electronics or any other goods you must take it back to the UK to enjoy. Also, there are no maximum limits so you can shop till you drop!

3. What goods DO NOT qualify for a refund?

There are a few goods & services to be aware of that cannot get you a VAT refund. These include services (i.e. tickets, hotels, bills), tobacco, pharmaceuticals, cars and car parts, foods already consumed and goods with no VAT.

Most other goods will be able to get you a refund as long as you make sure to get a ‘purchase invoice’ - this is important!

4. Purchase time requirements

When you make your purchase in France, you need to make sure that you leave France and the EU within 3 months following the month in which you bought your item in order to take advantage of VAT refunds. So if you purchase an item in January, you need to exit France before the 30th April to be eligible for VAT refund!

These are the most important things to keep in mind when purchasing goods you want to get a VAT-refund on.

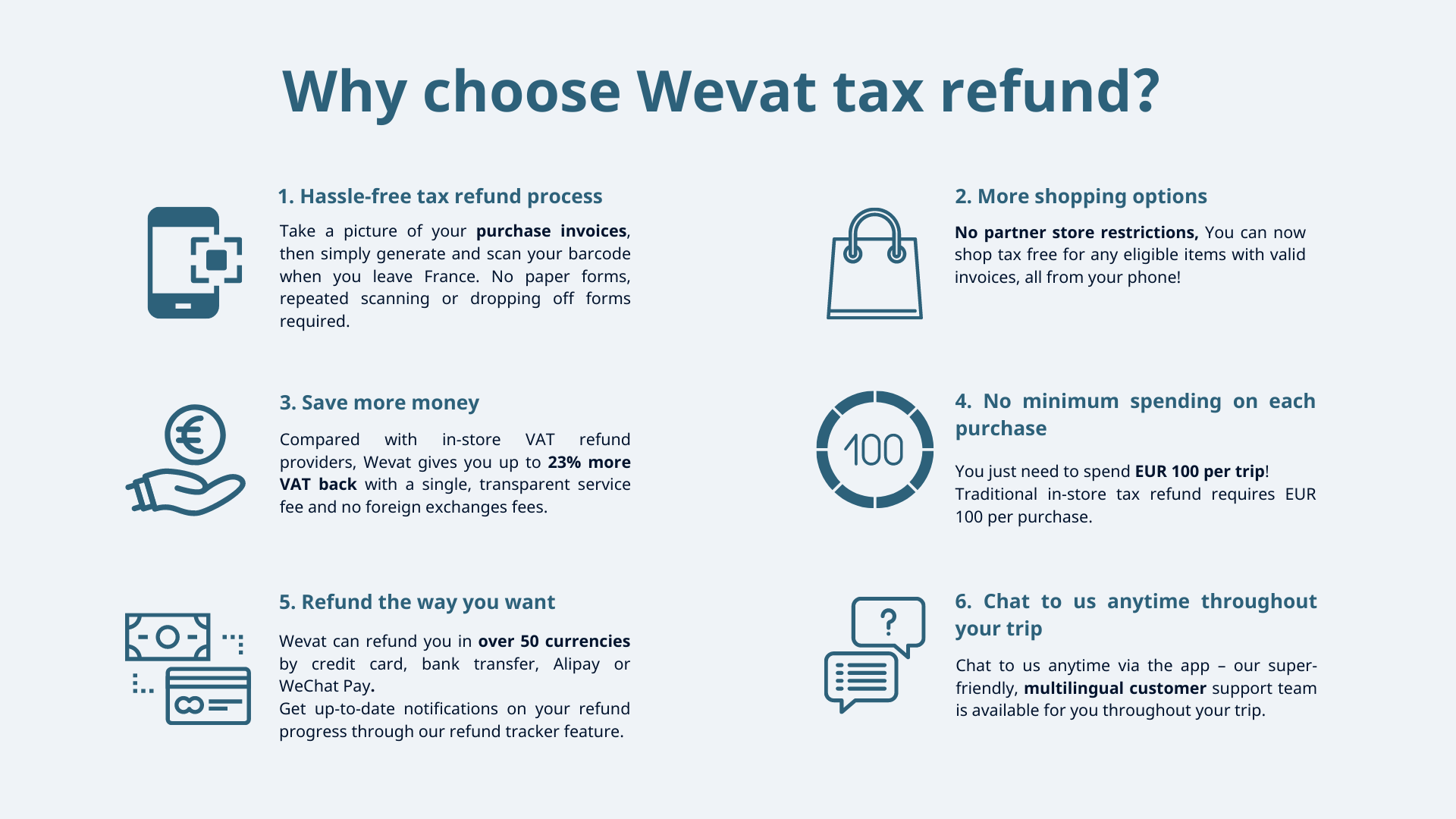

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now and start saving money on your shopping in France!

You might be interested in:

How does tax-free shopping work in France?

How can British tourist claim tax-refunds on shopping in France?

Please download before purchase to validate shopping.