How to get a VAT refund at Galeries Lafayette in France?

Galeries Lafayette Boulevard Haussmann

Famous the world over for its opulent department stores, Galeries Lafayette offers French and international visitors alike a fashionable feast of clothing, gourmet food and in-store events. With its range of affordable local French brands to high-end designer labels, there’s something for every visitor and it’s a must if you’re travelling to France. Galeries Lafayette boasts more than 50 stores including well-known and independent shops. This shopping mecca can be found across France in Paris, Lyon, Dijon, Orléans, Clermont Ferrand, Agen, Nice, Avignon, Montauban and Bayonne.

Its flagship store has been based in the heart of Paris for over 125 years. In fact, Galeries Lafayette Boulevard Haussmann is undoubtedly the most iconic department store in France; hosting over 3500 brands from budget-friendly to haute couture fashion within its stunning art nouveau architecture. Why not experience one of its weekly 30 min fashion shows highlighting the latest trends from the top fashion labels?

Wanting to offer a bespoke experience for the modern shopper, Galeries Lafayette Champs-Élysées, Paris was created in 2019, reinventing the department store ideals of the past with its digital innovations. “Smart hangers” on certain items tell customers useful things such as price, the nearest changing rooms and which other sizes are in stock!

Galeries Lafayette Nice Masséna

How to get a tax refund when shopping at Galeries Lafayette

Non-EU citizens, which includes British travellers as a result of Brexit, can now reclaim the tax on purchases made on a majority of items such as clothing, jewelry, electronics, beauty products, and much more. Check out our other blogs and help section for more information on what can or cannot be claimed for. As a general rule, things you will use on your trip like tickets and food are excluded. However, you can also get a tax refund on a box of macarons or chocolate as souvenirs, as long as it is unconsumed and in the original packaging.

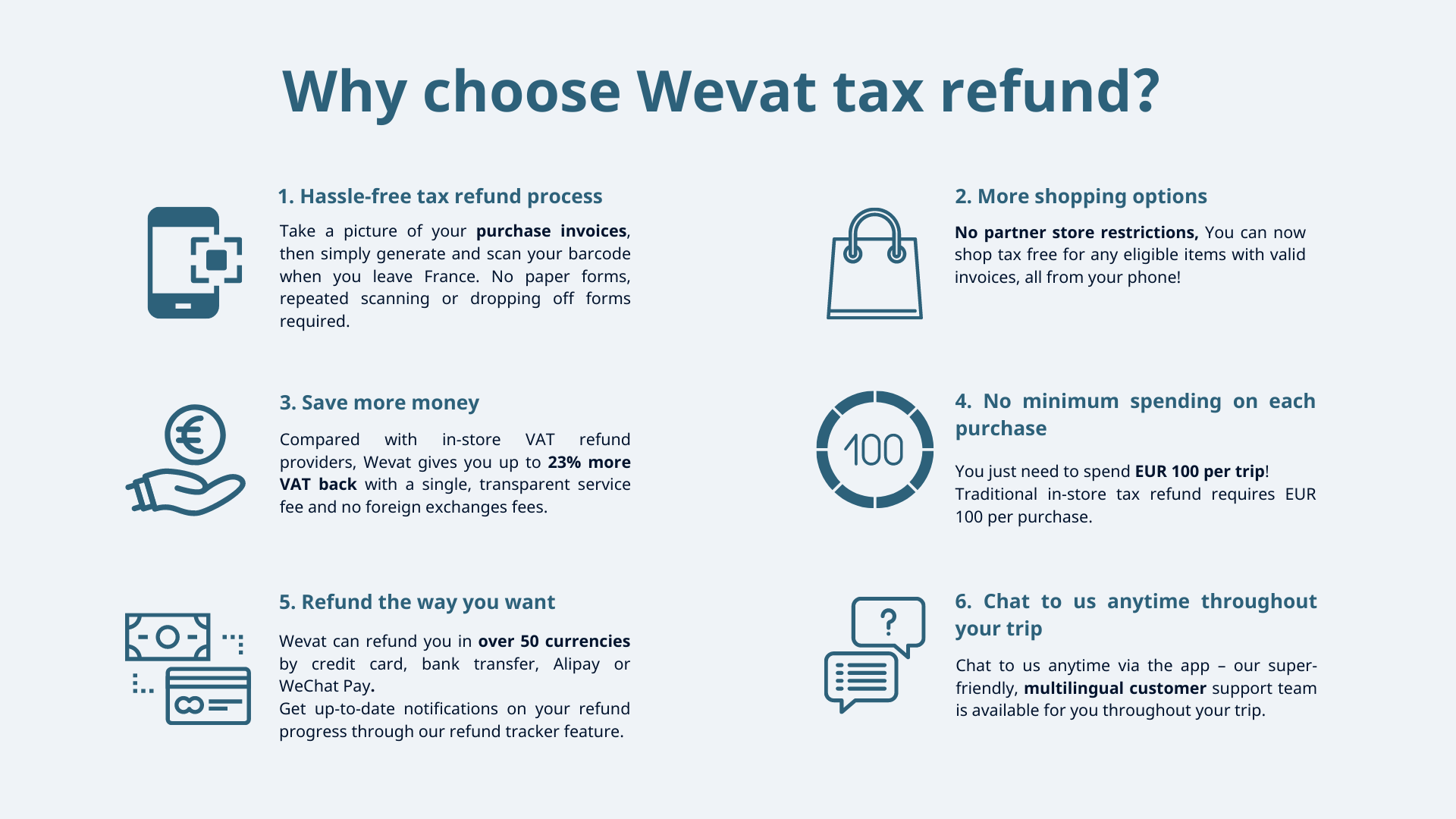

There are two main ways you can get a tax refund - using a traditional in-store paper method, or a digital app like Wevat. The main perk of using a digitalised method with Wevat is the higher refund rates you can enjoy compared with the in-store method. The refund process and payment received is also much quicker. Plus, you only have to spend a total of €100 across all your purchases rather than €100 per store. You also don’t need to remember to bring your passport around with you when shopping, much more convenient especially if you want to avoid theft or losing it while you stroll along the streets of Paris.

Traditional tax refund at Galeries Lafayette

Traditional method at Galeries Lafayette

Outside of the airports, Galeries Lafayette offers customers the ability to get an instant cash tax refund (for an increased refund fee) using its self-service machines.

In order to do this, customers need to be over the age of 16 living outside the EU, staying in Europe for less than six months and have their passport with them. Items cannot be purchased online and must also be made in one single day by the person named on the tax refund slip.

Refund methods via its interactive terminals in store include cash in store, deferred Alipay, payment into a bank account or cash at the airport. (Please check in store for the latest payment methods as these are subject to change). Payments can also take up to three months to be added to bank accounts.

Customers can obtain a 12% VAT refund (excluding any fees) on purchases of over €100 made at Galeries Lafayette Paris Haussmann over three consecutive days. This reduces to 10.8% back on purchases if instant cashback is chosen. The self-service machines detail step by step which documents to scan, how to complete the tax refund and the expected amount you’ll receive. Further paperwork is produced which still needs to be scanned at the Pablo tax refund kiosk and dropped off with any receipts using the supplied envelope to be posted into the boxes at the airport/customs areas.

Simpler tax refunds with Wevat at Galeries Lafayette

Choosing to use Wevat over the in-store method means fewer fees, less paperwork to keep track of, and a quicker refund in the currency you want. Compared to the 12% offered by traditional methods, Wevat instead offers customers up to 13% tax refund and is fully backed and regulated by the French government. Our five-step process below shows how much simpler life can be with Wevat!

Get VAT refund with Wevat at Galeries Lafayette

DOWNLOAD WEVAT APP – make sure you get set up before visiting the store

REQUEST A ‘FACTURE’ (invoice) - Show the ”request an invoice” in the app to get an invoice addressed to Wevat and not yourself

SNAP YOUR INVOICE – upload this straight to the app while in store

VERIFY YOUR CLAIM – follow the prompts on screen to get your digital refund form

SCAN AND GO – visit the tax refund kiosk within customs departure areas, scan the barcode on the Wevat app and off you go! Make sure to keep goods claimed on hand in case of checking (in unused and original packaging).

Examples of a valid facture and Wevat address can be found in the app. We also have helpful step-by-step videos on our YouTube channel.

Tips for getting an invoice

Ask for a “facture” (Invoice in French) with Wevat name and address (Click our mascot on the app homepage where you will see our request on an invoice screen. Show this screen to the store staff where it has Wevat’s info.

Do not mention tax refund form otherwise they will issue you a paper tax refund form from a traditional tax refund company.

FYI: Tourists have the right to use their own tax refund provider and stores are obligated to provide invoices upon request.

Request an invoice screen

Top tips - Summer and Winter Sales

If you want to save even more money don’t forget to time your trip to coincide with the French sales. Twice a year, France hosts huge sales in January and July called “les soldes” which normally last four weeks. Here you can experience increasing discounts as time goes on – sometimes as high as 75% off towards the end of the sales! These discounts apply to all kinds of products so it might be worth holding out for a sale if you are looking for certain electrical items or designer goods.

Summer and Winter Sales

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.