Say goodbye to UK tax refunds: Here's how travellers can still shop tax-free and save

Attention all savvy shoppers and travel enthusiasts! Some of you might have been aware that tax-free shopping for international travellers shopping in the United Kingdom has been discontinued.

In the past, international visitors to the UK were granted the exciting opportunity to enjoy tax refunds on their purchases, making their shopping experiences all the more exhilarating. This meant that you could shop to your heart's content, saving on valuable VAT and even taking your cherished finds back home with you. Oh, the joy of scoring incredible deals while exploring the beautiful cities of Great Britain!

However, starting from January 1, 2021, a wave of change swept across the nation as the UK government made the regrettable decision to discontinue the VAT refund scheme for tourists. Yes, you heard it right. The thrilling days of tax-free shopping in Great Britain (England, Scotland, Wales) have come to an end, leaving many of us with a sense of longing for those savings and bargains we once relished.

But fret not, fellow shoppers, for all hope is not lost! While we eagerly await news of the UK government's potential reconsideration and the reintroduction of the beloved VAT refund scheme, here‘re still ways for you to maximise your shopping experience in the UK/ Europe. So, let's dive into these exciting tips!

Shop duty-free in the UK

Shop and Ship at Selfridges, Harvey Nicholas and Harrods

While the VAT refund scheme may have bid us farewell, there's still a glimmer of hope for all you jet-setting fashion enthusiasts. One popular option is to shop at stores that offer international deliveries and tax-free shopping services when travelling to the United Kingdom. For instance, renowned department stores in London like Selfridges, Harvey Nicholas and Harrods provide this tax-free shipping option, allowing non-UK visitors to buy items in-store and have them conveniently delivered to their overseas addresses outside of the UK. This way, you can benefit from tax refunds on your purchases. For more information on tax-free shipping, please contact the customer service team of the store.

Selfridges

Shop Tax-Free in France

If you plan to visit neighboring countries during your trip to the UK, it's worth considering tax-free shopping opportunities there. This becomes especially appealing if you have your sights set on acquiring some high-end items, ranging from luxurious clothing and bags to exquisite jewelry, watches, and even cutting-edge electronic devices. For example, France offers a myriad of renowned fashion brands that originate from its stylish shores, presenting competitive prices and frequent sales events. You'll have the opportunity to indulge in your favourite brands such as Dior, Saint-Laurent, Céline, Hermès, Givenchy, Balenciaga and many more at a more affordable price.

But wait, there's more! France, along with other neighboring countries, operates a tax refund system for non-EU visitors like you, allowing you to relish the enticing perk of tax-free shopping. Goods in the EU contain VAT (value added tax), automatically added to your shopping and can be as much as 20-25% of the net price. If you're a non-EU traveller shopping abroad and take your purchases home with you to enjoy, you can get a refund on the tax that you've paid. For instance, if you purchase a bag for €1000 in France, you may save up to €130 by reclaiming your tax. Still a big save, isn’t it? Check out our other blogs and help section for more information on what can or cannot be claimed for.

Galeries Lafayette

How to get a tax refund on your shopping in France

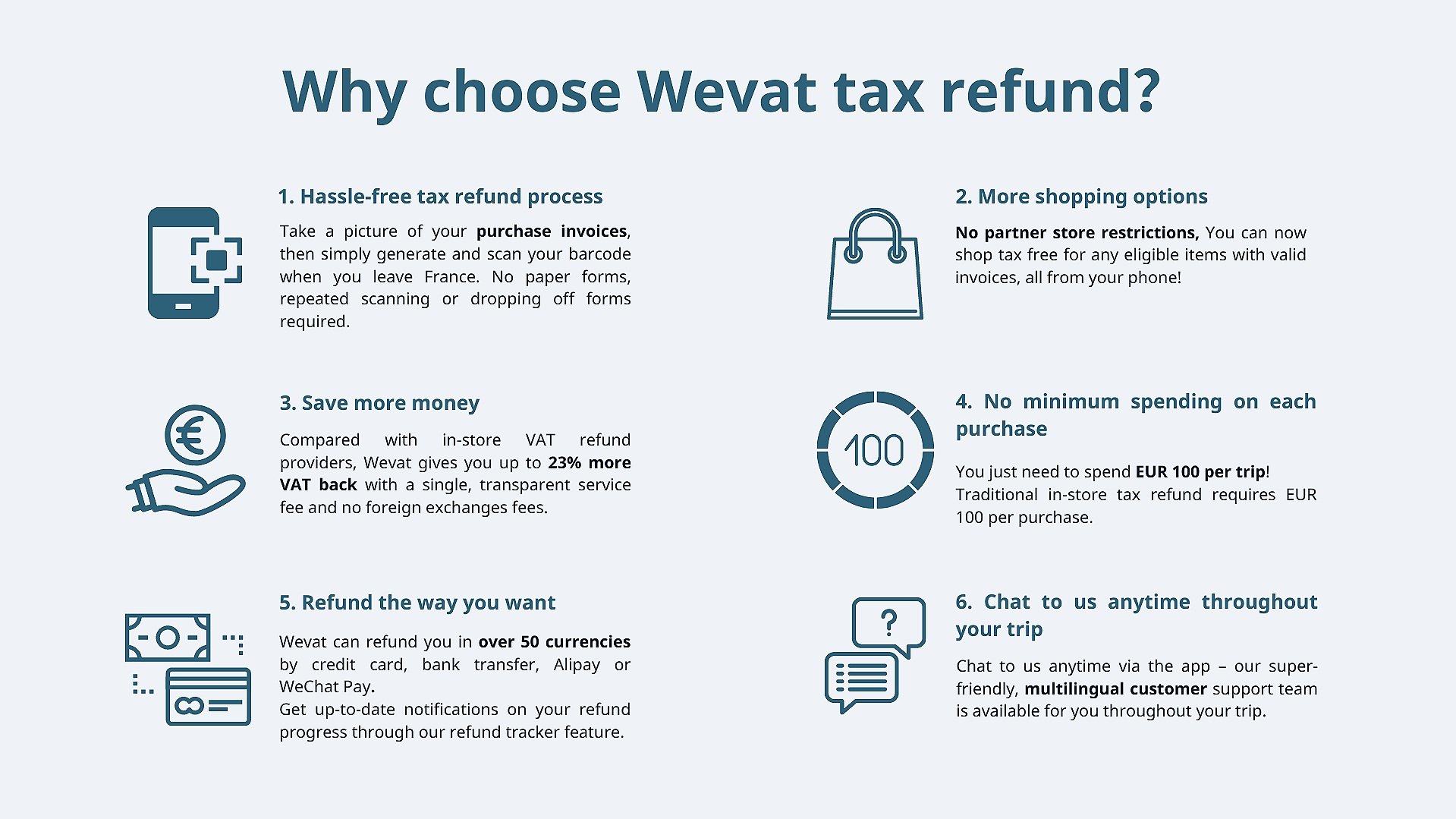

There are two main ways you can get a tax refund on shopping in France – using a traditional in-store paper method, or a mobile tax refund app like Wevat. The main perk of using a digital method like Wevat is the higher refund rates you can enjoy compared with the traditional in-store method, not to mention the convenience of not having to deal with paper forms ever again.

In the past, you’d have to bring your passport around with you when shopping and show it to the store every time you buy something to get a tax refund form. With Wevat, all you need to do is to ask for a purchase invoice addressed to Wevat at the till – no more hassle and waiting around at the checkout.

And another huge benefit of shopping with Wevat is that there’s no minimum spending required in a single store, as long as you spend a total of over €100 across all your purchases during your trip in France, you can claim your tax back!

When departing, traditional methods require you to undergo complicated airport procedures with customs, and you’ll have to wait up to 8 weeks to get your money back. Wevat’s scan-and-go system makes it much faster and easier, and you can track the refund progress from the in-app refund tracker or check with the friendly customer support team from the app. (See these articles to learn more about what you need to do at the airport, train station and ferry port you’re leaving from).

Tax refund kiosks at the airport in France

Recap of how to use Wevat

Follow these five steps to get your VAT back in a simple way with Wevat.

Download the app – make sure you have signed up and have onboarded before visiting the store

Request a ‘facture’ (invoice) - show the ”request an invoice” screen in the app to get a business invoice with Wevat's name and address. Make sure the invoice is not addressed to yourself!

Snap your invoice – upload it straight to the app, ideally immediately before you’ve left the store

Generate refund barcode – follow the prompts on the screen to get your digital refund form

Scan and go – visit the tax refund kiosk at your departure point, scan your refund barcode on the Wevat app, and off you go! Make sure to keep your goods on hand in case customs inspects the goods (in unused and original packaging).

Examples of a valid invoice and Wevat address can be found in the app. We also have helpful step-by-step videos on our YouTube channel.

Wevat tax refund app

Tips for getting an invoice:

Ask for a “facture” (Invoice in French) addressed to Wevat (Click our mascot on the app homepage to find the “request an invoice” screen. Simply show the screen containing Wevat’s address details to the store staff to get the right purchase invoice

Do not mention tax refund in the store, otherwise, the sales assistant will issue you a paper tax refund form from a traditional tax refund company and you will not be able to use Wevat

Request an invoice screen

While the end of tax refunds in the UK may be disappointing for international shoppers, you can still make the most of your shopping experience by exploring options like getting tax-free shipping at Selfridges and taking advantage of VAT refunds in France with Wevat. Remember to plan your purchases wisely, consider the costs and benefits, and make the most of your trip to Europe. Happy shopping!

About Wevat

Wevat is a digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love traveling, shopping, and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping.

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices and then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning, or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs and tax authorities.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.