VAT Refunds in France: 9 Common Mistakes to Avoid for Efficient Tax-Free Shopping

Claiming a VAT (Value-Added Tax) refund can significantly save money on your purchases made during your trip abroad, especially in a shopping paradise like France. However, navigating the tax refund process can sometimes be tricky for travellers. From not knowing the rules to mishandling necessary documents, there are several frequent mistakes that can end up costing you. But with a bit of knowledge, you can effectively avoid these problems.

In this blog post, we will list 9 common mistakes travellers make when claiming VAT refunds and provide tips on how to avoid them, helping you maximise your VAT savings on your next shopping trip in France.

1.Not Understanding VAT Refund Eligibility

Many travellers miss out on VAT refunds simply because they’re not familiar with the eligibility criteria. To qualify for a tax refund on shopping adventures in France, you must:

Have your permanent address outside the EU;

Be visiting the EU for less than six months; and

Be departing the EU for a non-EU country with your purchase within 3 months following the month in which you bought your item

Understanding these criteria is the first step towards claiming your VAT refund correctly. Before embarking on a shopping spree, double-check your eligibility here to avoid disappointment.

2. Not Meeting the Purchase Threshold

In addition to understanding the eligibility criteria, be sure to meet the minimum spending requirement to qualify for a VAT refund for the tax refund method you’ve chosen.

In France, there are generally two main ways to claim your tax refund – using the traditional in-store paper method, or through a digital app like Wevat. Both methods are operating under the regulations of French customs.

If you shop tax-free with the traditional in-store tax refund company, make sure each individual purchase exceeds €100 to qualify, while digital tax refund apps like Wevat allow for a total spend of more than €100 throughout your trip in France. This makes it easier to reach the minimum spend requirement without needing to make high-value purchases in one go. Plan your purchases wisely to ensure you meet the required amount.

3. Failing to Present and Obtain Proper Documentation

Proper documentation is key to successfully claiming your VAT refund. For traditional tax refund methods, filling out a paper tax refund form is essential, which you can do by presenting a valid passport at the time of every purchase.

If you're going down the digital route with the Wevat tax refund app, what you’ll need to ask for at the point of sale is a purchase invoice addressed to Vatcat France — no need to ask for a tax refund form for each purchase.

Show the “Request an invoice” screen on the Wevat app to the shop assistant, and they’ll help you with this. Once you upload your invoice through the in-app camara, the app then combines invoices together into a single digital refund form, accessible at any time on your phone.

4. Only Seeking Tax Refunds on Luxury Shopping

A common misconception is that VAT refunds are only applicable to purchases made in luxury retail stores and large shopping centres frequented by tourists. In reality, you can reclaim the tax on a wide variety of items, including clothing, jewellery, electronics, beauty products, and much more. The general rule is that you can claim VAT for items you intend to take home and not use immediately during your trip.

While not every store may offer traditional in-store tax refund forms, you can still enjoy tax-free shopping with the help of digital solutions like the Wevat app. It allows you to claim your VAT back as long as the store can provide a purchase invoice for eligible goods.

So, next time when you shop — whether at a chic boutique in Le Marais, or at a major retailer like an Apple store or Sephora store on the Champs-Élysées — remember to ask if they can issue the purchase invoice. This way, you won’t miss out on the VAT savings you’re entitled to.

5. Forgetting to Get the Tax Refund Validated by Customs

As your visit to France draws to a close and you prepare to head home, there's one vital step remaining in your VAT refund process: having your (e)refund forms validated by customs upon departure. Without this step, your refund claim is essentially invalid, and you won't receive any money back.

Before checking in your luggage, follow the “Détaxe” signs to the customs area. Here, you'll need to present your physical and/or digital refund form — like the one provided by the Wevat app. Be sure to plan extra time for this step, especially at busy airports, to ensure you complete it without having to rush.

Get the Tax Refund Validated by Customs

6. Not Carrying the Goods When Departing

As mentioned earlier, you can only claim a VAT refund for goods that are for personal use and taken with you when you leave the country. Therefore, when you go through customs, French customs may ask to inspect these items to make sure they haven’t been used during your stay.

To avoid complications, we strongly recommend keeping the goods sealed and in their original condition, and making sure they are easily accessible and with you. It’s best to pack them in your hand luggage so you don’t check them in by accident.

7. Not Using the Convenient Self-service Tax Refund Kiosks

You’re now ready to get your refund form validated. Instead of waiting in long customs queues for the manual stamping of refund documents, using the tax refund self-service kiosks can save time and reduce the stress of departure. These convenient kiosks are readily available at most major departure points throughout France, typically located near the Customs office.

You can check here for Wevat-supported departure points that are equipped with tax refund kiosks. Just follow the on-screen instructions, simply scanning the barcode on each paper tax refund form as well as the digital refund form from the app.

Using the Convenient Self-service Tax Refund Kiosks

8. Ignoring the Additional Service Fees

When checking your final refund amount, keep in mind that there’ll be additional service fees, exchange rates and bank transaction fees, which can reduce the total you receive.

Typically, customers can obtain a 10-12% VAT refund rate (excluding any fees) with traditional in-store tax refund methods. This can drop to 8-10% if instant cashback options are chosen. Wevat instead charges a single flat fee of 22% of your refund, which means you can expect a VAT refund rate of 13%. The app provides a transparent and detailed breakdown of each purchase, showing the original purchase amount, the service fee amount, and the VAT refund itself, enabling you to easily track exactly how much you're getting back.

9. Overlooking the Benefits of a Digital Tax Refund App

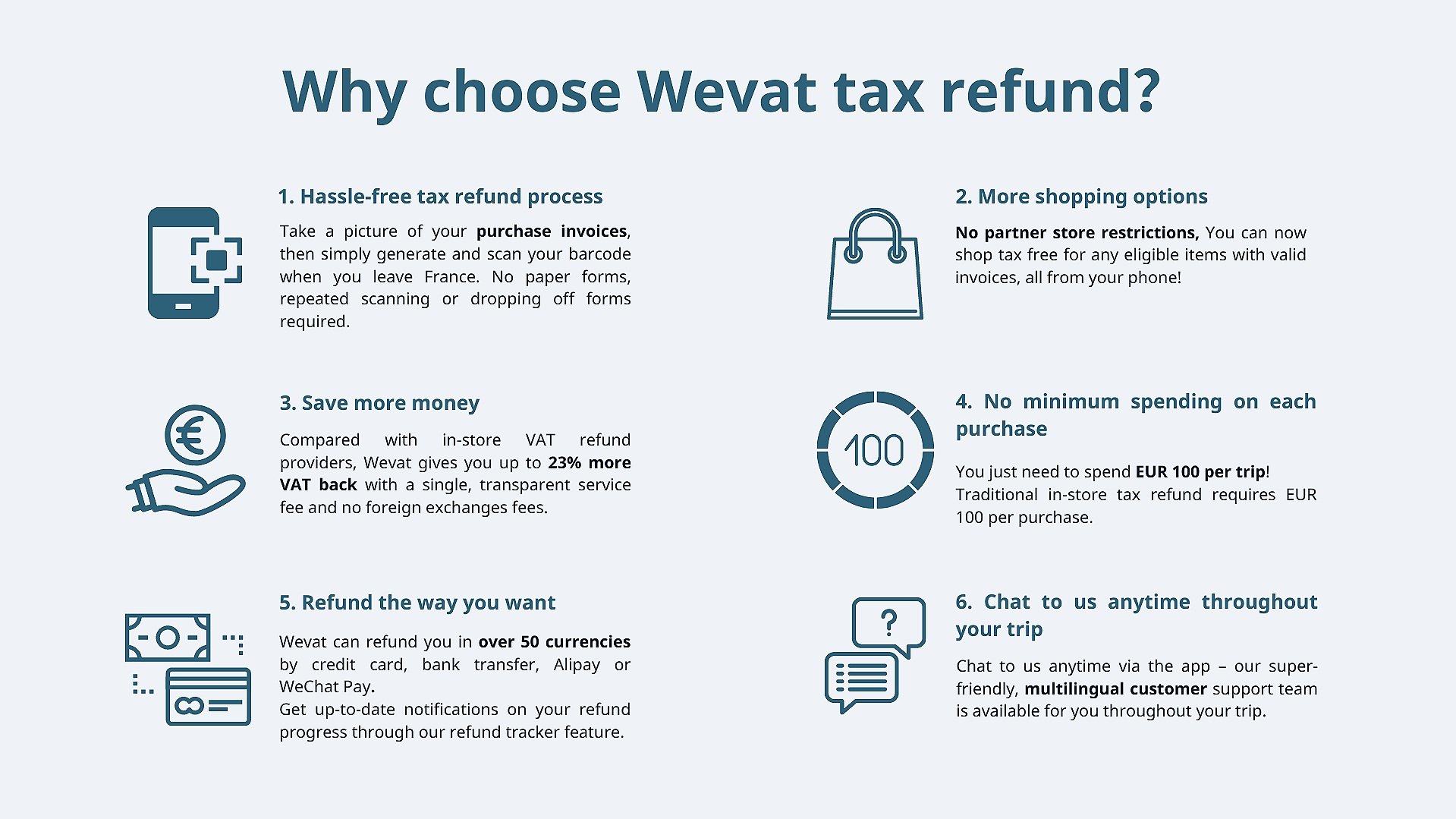

So far, we hope this guide has given you a clearer understanding of the tax refund process when travelling to France. If you're considering a way to simplify everything you've learned, a digital tax refund app like Wevat could be what you need.

It's not just about getting a higher refund rate or enjoying the flexibility of spend requirements across a broader range of purchases. It’s also about easing the usual burdens — no more manual paperwork filling, no need for repeated scanning and dropping off forms, and the reassurance of securely storing passport details within the app.

With Wevat, you’ll also stay informed with real-time updates on your refund status directly through the app’s refund tracker. And if you ever find yourself needing help, our super-friendly, multilingual customer support team is just a chat away, ready to help you throughout your journey!

Wevat Digital Tax Refund App

About Wevat App

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.