Tax-free shopping in the EU: Ultimate guide to VAT refund for tourists travelling in Europe

VAT refunds can be a tricky subject, especially when you're traveling to a foreign country. In Europe, the rules and regulations regarding tax refunds vary from country to country. To help you out, we've put together a complete guide to tax refunds in Europe, so you can get your money back without any hassle.

What is a VAT refund?

Goods in European countries contain VAT (value-added tax). This tax is automatically added to your shopping and can be as much as 20-25% of the net price. However, if you're shopping abroad and take your purchases home with you to enjoy, you can get a refund on the tax that you've paid.

Please note that there's no "do-it-yourself" when it comes to VAT refunds, so you'll always have to go through a VAT operator. How much your take-home refund comes to is based on the service fee charged by your VAT-refund provider, which range can vary across a large range. Typically, once all fees are deducted, you can expect to get somewhere between 6% - 15.5% of the ticket price back.

Who and what is eligible for a VAT refund?

To be eligible for a VAT refund on your shopping in the EU, you must:

have your permanent address outside the EU;

be visiting the EU for less than six months; and

be departing the EU for a non-EU country with your purchase within 3 months following the month in which you bought your item

You can reclaim the tax on purchases made on a majority of items such as clothing, jewellery, electronics, beauty products, and much more. As a general rule, things you will use on your trips like tickets and food are excluded.

What do I need to do to get a tax refund?

To get a VAT refund on shopping in the EU, there are two main steps you need to complete:

Get a tax refund form

Validate your refund form at customs before leaving the EU

Getting a refund form

There are two main ways you can get a tax refund form – using the traditional, in-store paper method, or a digital app like Wevat.

Using the traditional method, you’ll need to show your passport to the sales assistant, ask for a refund form, and do some form filling every time you buy something.

With a digital app like Wevat, you don’t need to do any of that – the app combines invoices together into a single digital refund form, accessible at any time on your phone. You can also leave your passport safely locked at your hotel rather than drag it around to every shop – eliminating the risk of it being lost or stolen.

Another perk of using an app is that you get more money back. For paper-based tax refund methods, retailers work in partnership with the traditional tax player and these shops will take a cut from your refund every time you shop. This means the refund you take home would be less than using a digitalised refund app like Wevat.

You’ll also find that many shops, especially high-street boutiques and small shops, are not set up to offer a VAT refund to tourists. However the digital refund app works even for purchases made at shops not set up to issue a refund form. Instead of asking for a refund form, you’ll need to ask for a purchase invoice instead.

Another huge advantage of the digital method is that there might be no minimum spend per purchase. Traditionally, you’ll need to spend over the minimum spending requirements per transaction to qualify for a VAT refund form, but digitally, you’re eligible as long as your spend across all your purchases during the whole trip exceeds the minimum requirement.

Validating your refund form

Whichever method you choose, you will need to validate your refund form at your final departure point before leaving the EU.

Many countries including France, Spain, Portugal, Belgium, etc. have electronic self-service tax refund kiosks to easily scan and validate your forms in a matter of minutes. Where this is not available, you will need to find the local customs office at the departure point and have a printed, paper version of your refund form physically stamped in order for it to be validated.

With a digital app, you’ll be able to track your refund in real time after leaving the EU, never having to worry about losing your refund. For the traditional method, if you don’t hear back after one month, go to the tax refund provider’s website and send them an email.

France airport détaxe / tax refund

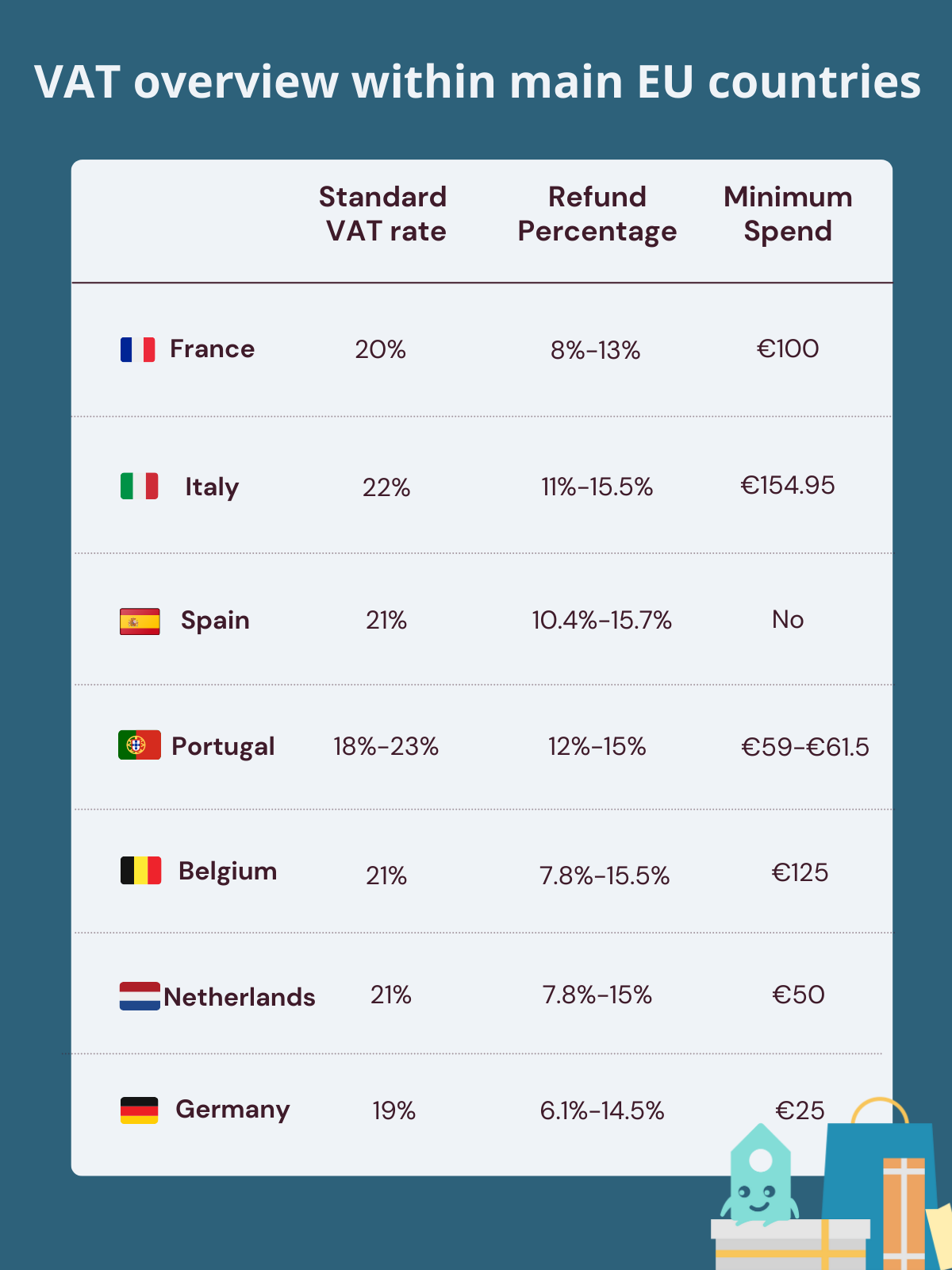

VAT overview within main EU countries

VAT refund in France

In France, the standard VAT rate is 20%. If you go down the traditional in-store tax refund method, you can only shop tax-free at shops that are partnered with traditional tax refund providers (like Global blue and Planet) such as big department stores. After these shops take a cut from your refund when issuing the paper-based tax refund form, the refund you take home would be 8%-12%. And you’ll also need to spend over the minimum requirement of €100 per purchase to be eligible for issuing a refund form.

To save money and time, you can use Wevat digital refund app for your shopping in France, refunded up to 13% of the price with €100 minimum amount per trip not per transaction, which means there’s no minimum spend per purchase and you can shop as many brands as you like. Check out our comparison of digital vs. traditional in-store tax refunds for more information.

Please remember to obtain a valid purchase invoice (or “facture” in French) when making purchases, and make sure it is addressed to Wevat. Instructions on how to do this can all be found in our app.

Take a shot of the invoice with the in-app camera, then upload it with a single tap. Wevat will generate a digital refund form with all of the purchase information, then simply scan the barcode in the app at the PABLO kiosk at the airport or station, no repeated scanning or dropping off forms required.

France tax free shopping App Wevat

VAT refund in Italy

In Italy, the standard VAT rate is 22%. After deducting the administrative fee and the fee of the tax refund company, you’ll expect to receive an 11%-15.5% refund rate of your purchase amount, depending on how much you spent. And Italy also has one of the highest minimum spending requirements (€154.95).

To get a tax refund, you’ll need to present your passport or other identity document proving your residence outside the EU. And the sales assistant will ask you to fill in a form with the necessary details. You’ll bring all your tax refund documents, passport, receipts, and purchases and get your tax refund forms scanned at the airport before leaving. Whether you need to return your form to the tax refund mailbox depends on which tax refund companies you’re using and please check the instructions with your VAT-refund provider.

VAT refund in Spain

Spain’s standard VAT rate is 21%, and the refund rate can be 10.4% to 15.7% of the purchase amount. It’s worth mentioning that there is no minimum spending requirement for a tax refund in Spain since 2018 July.

To shop tax-free, you’ll need to get your DIVA tax refund form and get it validated at the departure point. Before departing, be sure to first visit the DIVA kiosk with your passport, tax refund forms, and purchased items for a possible inspection, and scan the barcode on your form to validate your refund.

VAT refund in Portugal

In Portugal, the minimum purchase amount per store and VAT rate can differ for different regions:

Mainland: €61.50 (VAT 23%)

Madeira: €61 (VAT 22%)

Azores: €59 (VAT 18%)

After deducting the service fee, you may receive 12% to 15% of the purchase amount as your refund.

The process of claiming a refund is similar to in Spain, and there’ll e-Taxfree kiosks at the airport, where you can scan the barcode on your (e)forms before you depart.

VAT refund in Belgium

The standard VAT rate in Belgium is 21%, with a minimum spend of over €125 in the same store. And you’ll expect to receive a 7.8% to 15.5% of purchase amount refund rate of your purchase amount.

The tax claim process is also similar to the countries above, remember to get your (e)refund forms validated at the self-service tax refund kiosk or the customs office at your departing airport or train station. If they’re not validated then your refund will not be approved by customs.

VAT refund in Netherlands

Netherlands’ standard VAT rate is 21%, with a refund rate ranging from 7.8% to 15% of the purchase amount and a minimum purchase amount of €50, which has a similar refund rate as Belgium while holding a relatively lower minimum spending requirements.

Netherlands also has a similar tax refund process to go through, of which key steps involve filling out refund forms and getting them stamped before you leave. And you’ll expect your money back on your credit card in months.

VAT refund in Germany

The standard VAT rate in Germany is 19%. Germany also has one of the lowest minimum spending requirements at €25 and a relatively low refund rate from 6.1% to 14.5% of the purchase amount.

To claim a refund, you'll need to present your passport and receipts for any purchases that you want to be refunded. You can then claim your refund at the airport when you're leaving Germany for a non-EU destination.

VAT refund in the United Kingdom

Since 1 January 2021, visitors are no longer able to purchase items in stores in Great Britain under the VAT Retail Export Scheme. This means you can’t buy tax-free goods such as electronics and clothing if you are travelling to non-EU countries. You can only buy VAT-free items in-store if you have the goods sent directly to overseas addresses (you can’t bring them out yourself).

Recently, the British government is considering reintroducing a “modern, digital, VAT-free” shopping scheme to attract international visitors and drive economic growth, which will enable tourists to once again claim a VAT refund on purchases made in Great Britain. This is still under discussion, be sure to follow us for updates and news.

However, the good news is, after Brexit, residents of England, Scotland and Wales who are shopping in the EU are also eligible to shop tax-free, which means they can enjoy savings by reclaiming the VAT on purchases made on a majority of items such as fashion items, cosmetics, technology, jewellery, wine, and many more goods with the digital tax refund app Wevat when travelling in France and save up to 13%. Check out our other blogs to learn more about how to save money on purchases by shopping tax-free. We also have helpful step-by-step guides and videos on our How it works page.

VAT overview within main EU countries

We hope this guide is helpful in clarifying how tax refunds work in main European countries. There are several things for you to remember:

If you’re travelling to a few destinations on a trip, you’ll need to claim your tax refund at the customs of the last EU country you leave from

You can only get a tax refund on goods that you’re bringing outside of the EU to use for yourself, and the customs may ask to see these goods at the airport/ train station/ port. Therefore, be sure not to consume them until you’ve left the EU

If you have any more queries or questions regarding tax-free shopping or about Wevat then please contact us via the live chat in our app!

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.