Shopping online during your stay in France? Here’s how to get a tax refund on Amazon online shopping

Online purchases are now accepted for tax refunds on Wevat!

With tax refunds now also available for online purchases, the number of ways you can save money whilst shopping for your favorite clothes, electronics and household goods has gone up again. Not only can you compare prices across different platforms, but you can also make use of discount codes, and cashback sites, and benefit from seasonal promotions. On top of all that, if you’re an eligible traveler, you can maximise your savings by shopping tax-free for online purchases delivered in France.

Tax-free shopping in the past has only worked when you bought something in France at a physical, brick-and-mortar store. However, with Wevat, you can now benefit from the same tax refund perks even when shopping online, as long as you ship the goods to the address you’re staying at in France, and bring the goods you have bought online out of France and back to your non-EU residence when you leave the country.

In the last few months since our online shopping service was launched, these are the kinds of things that our customers have shopped for online, using Wevat to claim a tax refund:

Apple MacBooks and AirPods

Canon DSLR mirrorless cameras

Sony headphones

Philips Sonicare and hairdryer

Claim a tax refund on purchases on electronics using Wevat

But the good news is that it’s not just limited to electronics. You can do the exact same for clothing, accessories, beauty, and household products, with no minimum spend per order. Check our guide for a list of eligible goods.

And if you’re savvy enough to time your purchases, you can even avail of the upcoming Amazon France Prime day or Black Friday. A Sony a6000 camera would have set you back by £499 on Amazon UK. But with sales season and tax refunds on Amazon France, you can get the same camera for £425 – a fraction of what it’d cost otherwise.

Tempted to try this out for yourself? Here’s our step-by-step guide on how to get a tax refund on Amazon purchases.

Before shopping, you need to ensure:

You are shopping at a French-registered retailer, which has a “VAT” or “TVA” number starting with “FR” on the invoice (’facture’ in French). We suggest you check with the retailer before you shop.

It must be delivered to an address in France. This can be your hotel, your Airbnb, your friend’s home, or a collection point such as Pickup France.

You are eligible to use Wevat and shop goods that are eligible for a tax refund. Check out our FAQ page to learn more.

How to get a tax refund for Amazon online shopping?

Step 1: Sign up to Wevat and check your eligibility, then shop at Amazon.fr

Step 2: Choose your delivery address in France

Step 3: Enter the following details under the billing address section to obtain an invoice addressed to Wevat:

Company name: Vatcat France

Address: 41 Cours de la Liberté, 69003 Lyon

IMPORTANT- Please make sure you have entered our address as the billing address, and not the delivery address. Otherwise, the delivery may end up at our office instead of with you.

Entering Wevat details under the billing address section

Step 4: Once you have received the goods, please forward your invoice to e-invoices@wevat.com and insert the email address linked to your Wevat account in the subject line. It’ll show in the Wevat app after successfully verified by us.

Amazon.fr e-invoice example

Step 5: Generate your in-app barcode and scan it at your departure point airport, Eurostar station, or ferry terminal. Make sure to have your unused online and offline goods ready for inspection at customs at departure.

Step 6: Receive your refund – this will be confirmed within two days after your departure.

Sounds too easy to be true? Well, it is both too easy and true. So start shopping the Amazon bargain now, on or before your trip to France and save money with tax-free shopping using Wevat!

About Wevat App:

Wevat - a new digital tax refund app that makes it easy for travellers to save money on their shopping in France! We are a community of people who love travelling, shopping and saving money. Since our launch in 2019, we've helped refund travellers from 88 countries more than €18 million on their shopping!

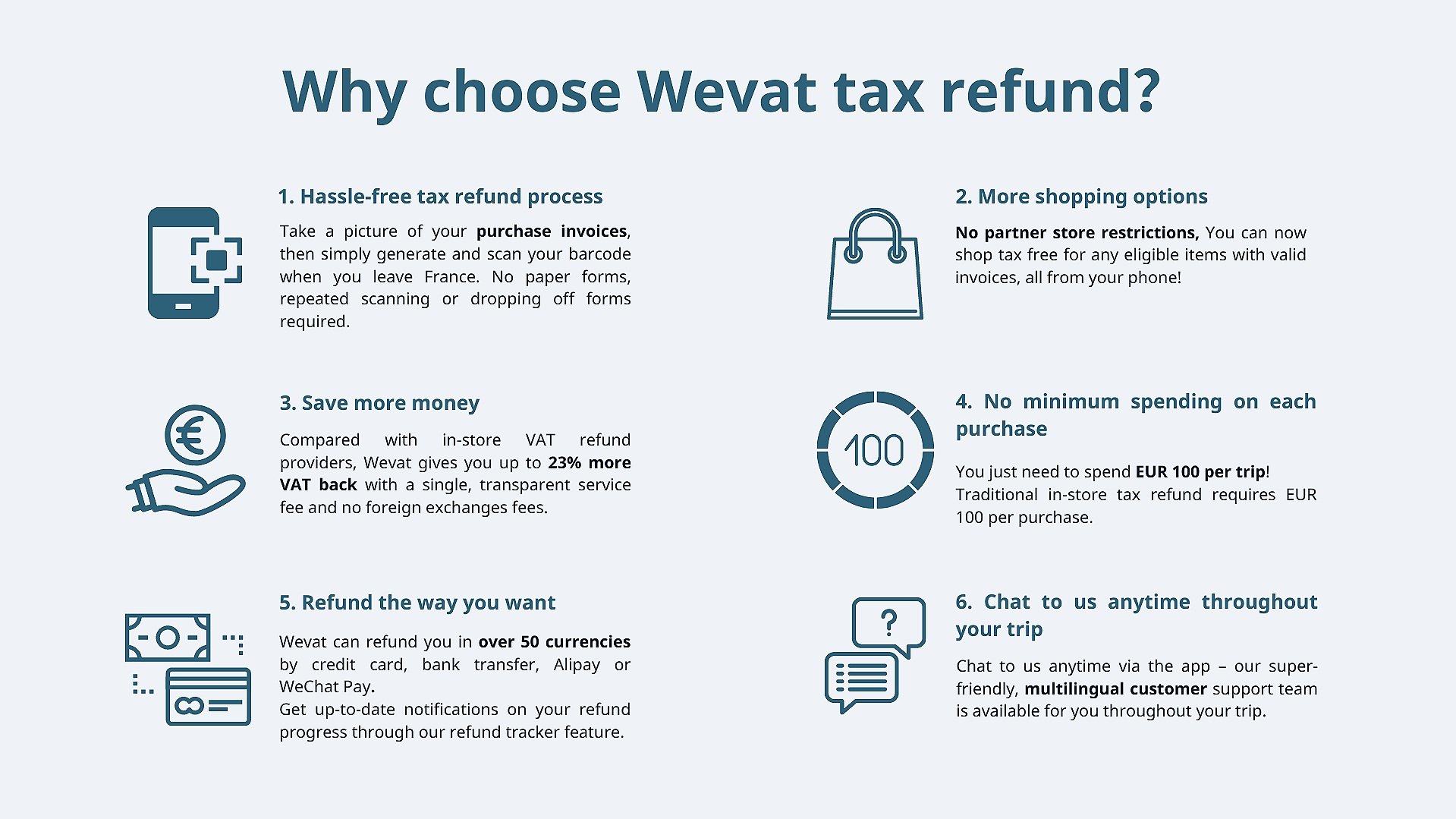

Compared with in-store VAT refund providers, Wevat gives you up to 23% more VAT back and with no minimum spending requirements on each purchase. With Wevat, you can simply snap a picture of your purchase invoices then generate and scan your barcode when you leave France. There are no paper forms, repeated scanning or dropping off forms required with us. Our super-friendly, multilingual customer support team will be always on hand to support you throughout your trip via our app.

We are fully regulated by both French and UK customs.

Download our app now to start saving money on your shopping in France!

Please download before purchase to validate shopping.